How to file Income Tax Returns online for free before Dec 31 deadline on incometax.gov.in

File your income tax returns online for free by visiting the official website of Income Tax Department- incometax.gov.in. Check steps.

The due date for filing Income Tax Returns (ITR) for AY 2021-22 is nearing and the Income Tax Department has reminded taxpayers to file the same today. It can be noted that the last day to file the returns is December 31, 2021. Every individual who is earning can file Income Tax Returns (ITR). In fact, it can be filed by individuals whose income does not even lie in the income tax bracket. Taking to its official Twitter handle, Income Tax India tweeted, "Dear Taxpayers! Just a gentle reminder that the due date for filing Income Tax Returns for AY 2021-22 is 31st December, 2021. Don't wait, File TODAY! Pl visit: http://incometax.gov.in."

Income tax return is a form filed by an individual to report his/her annual income. The form enables you or any taxpayer to declare your income, expenses, tax deductions, investments, among others. Taxpayers who have not yet filed their returns should know that it can be done in two modes - offline and online. The facility of electronic filing (e-filing) of an income tax return is being provided by the Income Tax Department. Here are the steps which can be used to file the ITR online for free on the Income Tax Government Portal.

Dear Taxpayers!

— Income Tax India (@IncomeTaxIndia) December 20, 2021

Just a gentle reminder that the due date for filing Income Tax Returns for AY 2021-22 is 31st December, 2021.

Don't wait, File TODAY!

Pl visit: https://t.co/GYvO3n9wMf#ITR #FileNow pic.twitter.com/36LoJ3g5eA

How to file ITR Online for free on Income Tax dept portal, incometax.gov.in

The pre-filling and filing of ITR-1 and ITR-4 service is available to registered users on the e-Filing portal.

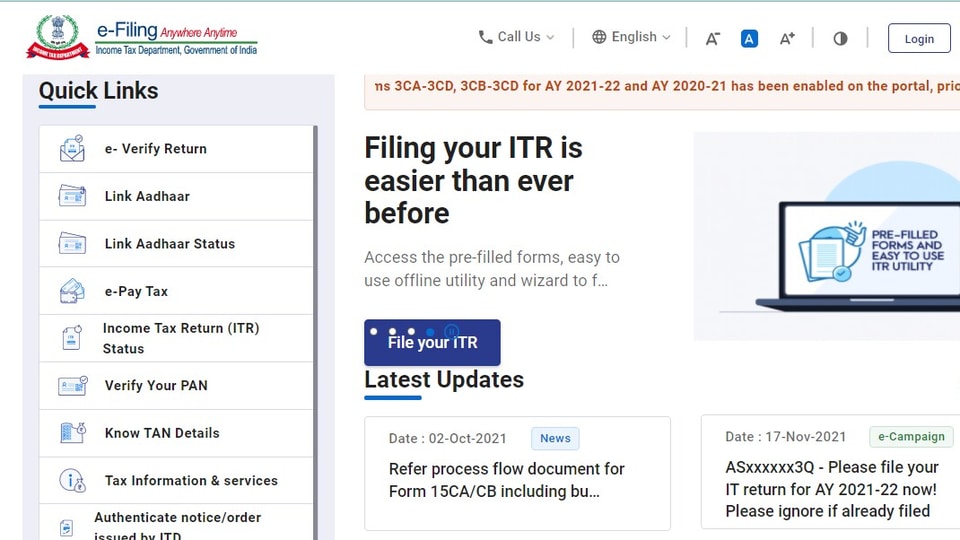

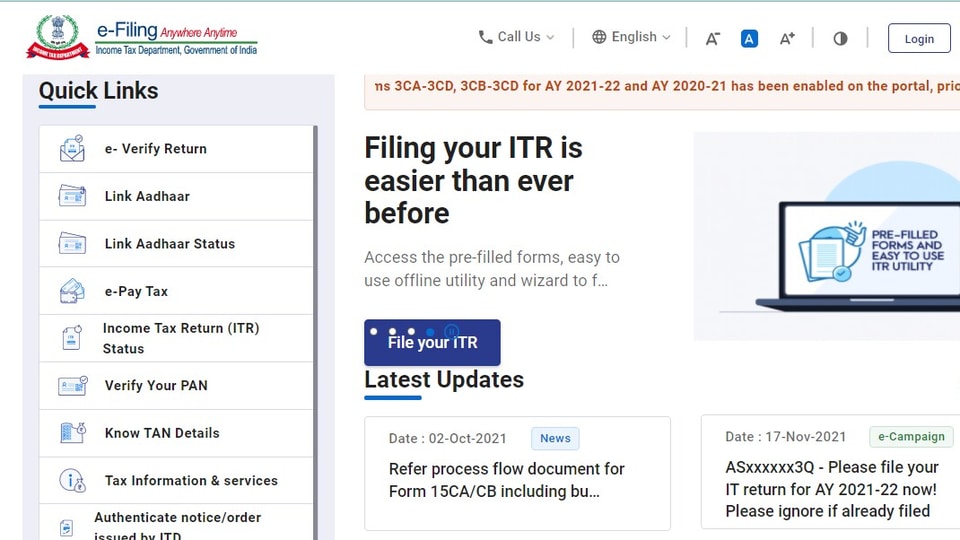

Step 1: Visit the official Income Tax Portal at https://www.incometax.gov.in/iec/foportal.

Step 2: Log in to the e-Filing portal using your user ID and password.

Step 3: On your Dashboard, click e-File > Income Tax Returns > File Income Tax Return.

Step 4: Select Assessment Year as 2021 – 22 and click Continue.

Step 5: Select Mode of Filing as Online and click Proceed. It can be noted that in case you have already filled the Income Tax Return and it is pending for submission, click Resume Filing. In case you wish to discard the saved return and start preparing the return afresh click Start New Filing.

Step 6: Select Status as applicable to you and click Continue to proceed further.

Step 7: You have two options to select the type of Income Tax Return:

If you are not sure which ITR to file, you may select Help me decide which ITR Form to file and click Proceed. Once the system helps you determine the correct ITR, you can proceed with filing your ITR.

If you are sure which ITR to file, select I know which ITR Form I need to file. Select the applicable Income Tax Return from the dropdown and click Proceed with ITR.

Step 8: Once you have selected the ITR applicable to you, note the list of documents needed and click Let's Get Started.

Step 9: Select the checkboxes applicable to you and click Continue.

Step 10. Review your pre-filled data and edit it if necessary. Enter the remaining / additional data (if required). Click Confirm at the end of each section.

Step 11: Enter your income and deduction details in the different section. After completing and confirming all the sections of the form, click Proceed.

Step 12: In case there is a tax liability

You will be shown a summary of your tax computation based on the details provided by you. If there is tax liability payable based on the computation, you get the Pay Now and Pay Later options at the bottom of the page.

Step 13: In case there is no tax liability (No Demand / No Refund) or if you are eligible for a Refund

After paying tax, click Preview Return. If there is no tax liability payable, or if there is a refund based on tax computation, you will be taken to the Preview and Submit Your Return page.

Step 14: On the Preview and Submit Your Return page, enter Place, select the declaration checkbox and click Proceed to Validation. If you have not involved a tax return preparer or TRP in preparing your return, you can leave the textboxes related to TRP blank.

Step 15: Once validated, on your Preview and Submit your Return page, click Proceed to Verification. If you are shown a list of errors in your return, you need to go back to the form to correct the errors. If there are no errors, you can proceed to e-Verify your return by clicking Proceed to Verification.

Step 16: On the Complete your Verification page, select your preferred option and click Continue. It is mandatory to verify your return, and e-Verification.

In case you select e-Verify Later, you can submit your return, however, you will be required to verify your return within 120 days of filing your ITR.

Step 17: On the e-Verify page, select the option through which you want to e-Verify the return and click Continue.

If you select Verify via ITR-V, you need to send a signed physical copy of your ITR-V to Centralized Processing Center, Income Tax Department, Bengaluru 560500 by normal / speed post within 120 days.

Make sure you have pre-validated your bank account so that any refunds due may be credited to your bank account.

Once you e-Verify your income tax returns filing, a success message is displayed along with the Transaction ID and Acknowledgement Number. You will also receive a confirmation message on your mobile number and email ID registered on the e-Filing portal.

Catch all the Latest Tech News, Mobile News, Laptop News, Gaming news, Wearables News , How To News, also keep up with us on Whatsapp channel,Twitter, Facebook, Google News, and Instagram. For our latest videos, subscribe to our YouTube channel.