Don’t know how to e-file ITR online? Here are simple and easy steps

Filing Income Tax Return can be a hectic process for most people. Check out these quick and easy steps to e-file ITR from the comfort of your home.

Are you yet to file the Income Tax Return? If yes, then you must know that you can file your income tax return online from the comfort of your home. The Process to file Income Tax Returns (ITR) online is called E-filing. The process to e-file ITR is quick, and easy. It can even help in saving money as you would not have to hire a professional to file ITR. You will be required to calculate your income tax liability as per the provisions of the income tax laws and use your Form 26AS to summarise your TDS payment for all the 4 quarters of the assessment year. Here's a step-by-step guide to e-file ITR

How to file ITR online: Here are simple and easy steps

|

|

|

|

| 30 Minutes |

|

|

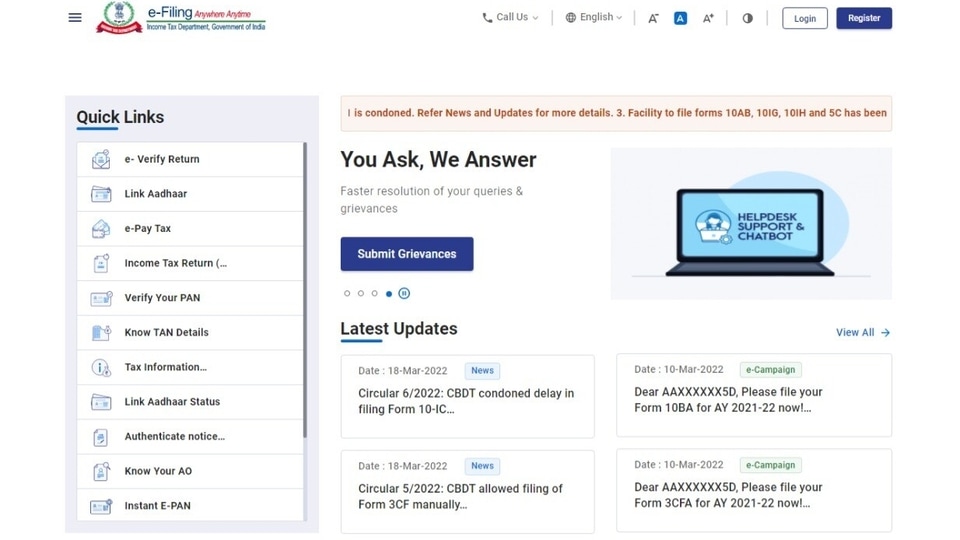

Firstly, you will have to log onto the official website of Income Tax department eportal.incometax.gov.in and register by filling in your PAN Card details.

Once the registration is done, click on the e-file tab available on the next page and then proceed to File Income Tax Return.

Now choose the assessment year for which you want to file your ITR and select the mode of ITR filing - Online or offline.

Once the assessment year is selected, you can choose to file yourr returns as an individual, a Hindu Undivided Family (HUF) or Other.

Once done, choose an ITR form. It must be noted that ITR forms 1 and 4 are for salaried individuals, while ITR form 2 is filed by individuals and HUFs who do not have income from a business or profession. ITR 1 covers income from salary, housing property, and other sources (except casual income), however, ITR 4 covers all of this plus presumptive business income.

Those who want to file income tax returns, need to calculate their income tax liability as per the provisions of IT laws. You can use Form 26AS to summarize TDS payment for all four quarters of the assessment year.

After this, fill in the details of your bank account and validate it.

You will be led to a page where all the information is filled in. Ensure that all the details are correctly filled.

Now proceed to the final step i.e, e- verify the returns and submit the entry.

Catch all the Latest Tech News, Mobile News, Laptop News, Gaming news, Wearables News , How To News, also keep up with us on Whatsapp channel,Twitter, Facebook, Google News, and Instagram. For our latest videos, subscribe to our YouTube channel.