Apple iPad sales disappoint, Street eyes the holidays

Apple Inc delivered a second straight quarter of disappointing results and iPad sales fell well short of Wall Street's targets, marring its record of consistently blowing past investors' expectations.

Apple Inc delivered a second straight quarter of disappointing results and iPad sales fell well short of Wall Street's targets, marring its record of consistently blowing past investors' expectations.

Shares in the world's most valuable technology company briefly dipped to levels not seen since the start of August, after it delivered a 27 percent rise in fourth-quarter revenue and a 24 percent increase in earnings.

The numbers, while in line with expectations, lacked the positive surprises that investors have grown used to, and came after Apple undershot revenue targets in the previous quarter. Its shares bounced back after CEO Tim Cook told analysts on a conference call that the latest iPhone 5 was heavily backlogged but the company had mostly worked out kinks in its supply chain.

Apple shipped 26.9 million iPhones in the last quarter, just ahead of analysts' predictions, but iPad sales of 14 million were well below lowered forecasts for the tablet as the economy remained weak and consumers awaited the iPad mini, which will hit store shelves next month. South Korean rival Samsung Electronics Co (005930.KS) sold 56.3 million smartphones in the quarter, according to research firm IDC, giving it 31.3 percent global market share, more than double that of Apple.

Fevered competition

Analysts say the real test for Apple will come during the crucial year-end holiday shopping season, when competition will reach fever-pitch against new gadgets from Amazon.com Inc (AMZN.O), Google Inc (GOOG.O) and Microsoft Corp (MSFT.O).

'Going into earnings we were wondering if the slowing economy will catch up with Wall Street, and it has,' said Channing Smith, co-manager of the Capital Advisors Growth Fund.

'Apple is very well positioned with the iPad and now the iPad mini. It has a great smartphone and we expect the iPhone 5 to sell very well. The outlook is conservative, but that's not surprising. Err on the side of caution is a proven formula.'

Apple heads into the current quarter after refreshing almost all of its product lines, including introducing an upgraded, fourth-generation full-sized iPad. The December quarter will show how well consumers respond to its latest gamble - the iPad mini - which goes on sale on November 2.

Quarterly revenue in China, Apple's second-largest market, rose 26 percent, and jumped nearly 80 percent to $23.8 billion over the full year, contributing 15 percent of Apple's total, Cook told analysts. Apple plans to launch the iPhone 5 in China in December, hoping to staunch market share loss in what is set to become the world's largest smartphone market this year.

Apple's China smartphone market share almost halved to 10 percent in April-June as buyers waited for the iPhone 5.

One week less

For the December quarter, Apple forecast revenue of $52 billion, below the average estimate of $55 billion, according to Thomson Reuters I/B/E/S. It expects margins of 36 percent, far lower than analysts' expected 43 percent.

Chief Financial Officer Peter Oppenheimer mostly attributed the lower margin and conservative guidance to a combination of a stronger dollar, higher costs associated with new products, and the fact that Apple's next fiscal quarter has one less week than the same period a year ago.

Apple's stock was holding steady at $609.40 in extended trade after flirting with the $600 level. The shares had ended regular trade at $609.54.

Supply constraints holding up sales of the iPad and iPhone dominated discussions between analysts and Apple executives during the post-results conference call. Apple had struggled to deliver large quantities of the iPhone 5 since its launch in late September, with the waitlist for the device at one point stretching to three weeks in some regions.

'Our supply output is significantly higher than it was earlier in October,' Cook said, referring to the iPhone 5. 'And I'm confident we'll be able to supply quite a few during the quarter.'

Car that flies and floats

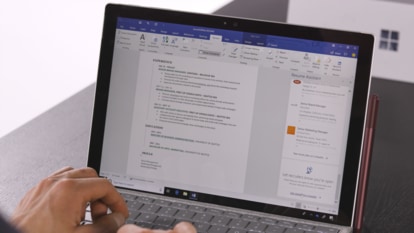

Cook also opined on Microsoft's (MSFT.O) new Windows 8-based Surface tablet that will hit stores early on Friday.

'I haven't personally played with the Surface yet, but what we're reading about it, is that it's a fairly compromised, confusing product,' he said. 'I suppose you could design a car that flies and floats, but I don't think it would do all of those things very well.'

Despite the lackluster fourth quarter, Apple put up big numbers for the year, ending its fiscal 2012 with a 45 percent increase in revenue to $156.5 billion, while net income was up 61 percent at $41.7 billion.

For the final fiscal quarter, it posted net income of $8.2 billion, or $8.67 a diluted share, on revenue of $35.96 billion, versus $6.6 billion, or $7.05 a share, a year earlier. Analysts had expected on average that Apple would earn $8.75 per share.

Apple ended the quarter with $121.3 billion in cash and securities, of which $83 billion was offshore.

Catch all the Latest Tech News, Mobile News, Laptop News, Gaming news, Wearables News , How To News, also keep up with us on Whatsapp channel,Twitter, Facebook, Google News, and Instagram. For our latest videos, subscribe to our YouTube channel.