Paytm Payments Bank enables e-RUPI prepaid vouchers

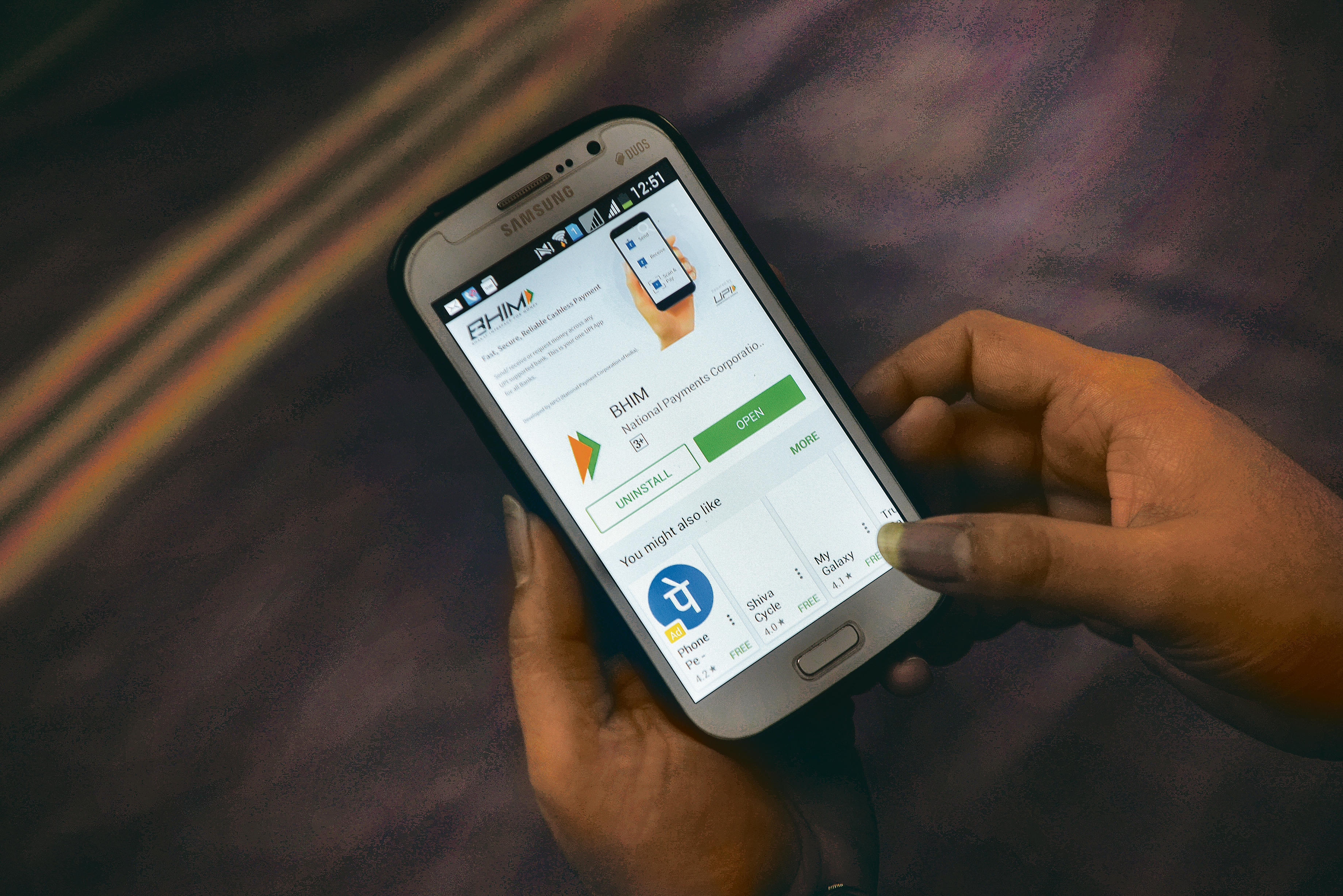

To promote offline digital payments, Paytm has enabled merchants to accept e-RUPI prepaid vouchers, with a new payment collection method helping them increase their digital presence, onboard new customers and include those who do not have access to formal banking services or smartphones.

First Published Date: 25 Feb, 11:21 IST

Tags:

paytm

Trending:

beware! your whatsapp account can be hacked easily; here’s how this cybcercrime works

how to change whatsapp font style and font size in chat window

this horrifying whatsapp scam can hijack your account with just a phone call

use of whatsapp plus, gb whatsapp got your whatsapp account banned? here is how to fix it

hide yourself! here is how to use the secret iphone incognito mode

get netflix, amazon prime, disney + hotstar and jio tv for free! just do this

did facebook really change its logo? see if you can spot the difference

forget microsoft windows 11, download android apps meant for smartphones on your computer now via bluestacks

big relief! your google storage plan increased to a fantastic 1tb for free

how to restore whatsapp chat history on android: check tips and tricks

NEXT ARTICLE BEGINS