More Google searches for ‘Trump Win’ than for ‘Biden win’

Google queries for the phrase “Trump win” have accelerated versus those for “Biden win” in recent months, widening a gap between the two that’s held since March, internet search data show.

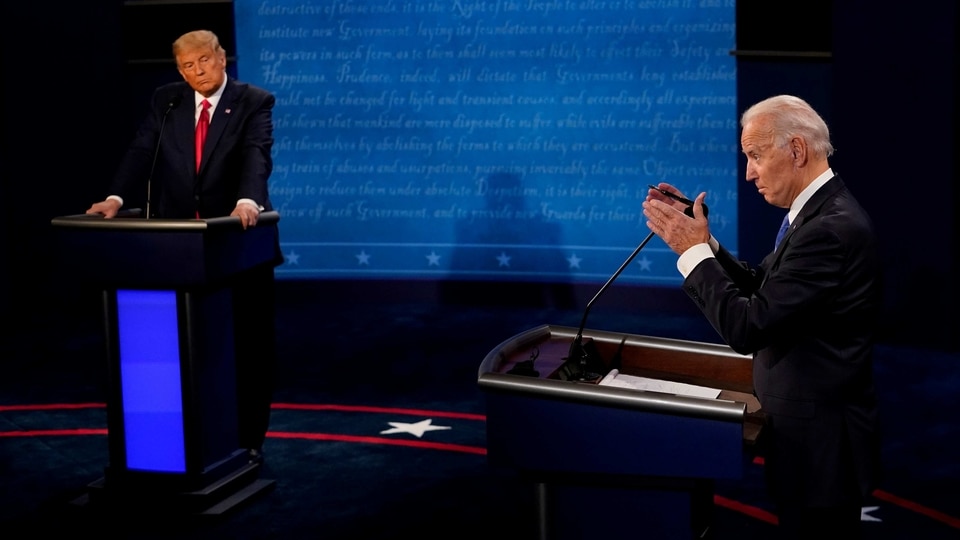

Days away from the presidential election, polls give Joe Biden the biggest lead over Donald Trump since Barack Obama trounced John McCain in 2008, yet web searches in the US suggest voters are squarely focused on gauging how Trump may still find a path to victory.

Google queries for the phrase “Trump win” have accelerated versus those for “Biden win” in recent months, widening a gap between the two that's held since March, internet search data show. Whether this reflects hope, fear or expectation is unclear, but the additional interest echoes that of market strategists, with prognosticators in recent weeks easing up on predictions for a sweep of Democratic victories to discuss the reverse -- the possibility the incumbent wins.

Of course, analysts have research notes to populate, and the memory of 2016's upset is a salient reminder to consider all outcomes. Polls suggest Biden is in a commanding position, with FiveThirtyEight giving him an 8.8 point lead over Trump. And, by early Friday, more than 82 million Americans had cast their votes, with a third more registered Democrats than Republicans known to have done so, according to data compiled by Michael McDonald, a professor of political science at the University of Florida.

Also Read: Microsoft quietly prepares to avoid spotlight under Biden

But there's a lot at stake. Global financial markets haven't just been buying into the polls that Biden will take the White House; they've also priced in the idea of a so-called blue wave in which Democrats win both chambers of the US Congress, bringing with them a flood of economy-boosting aid.

“Part of the risk-off shift we've seen in the markets lately is people realize that yes, fiscal stimulus may be coming, but we really don't have any idea what it will be as it depends on the fate of the election,” said Zachary Griffiths, a rates strategist at Wells Fargo. “And we really don't have any idea what is going to happen next week.”

A team of strategists at JPMorgan Chase & Co. warned this week that a surprise Trump election win could benefit US equities and the dollar while hampering Asian assets. That's based on market moves after Trump unexpectedly won the vote in 2016, according to a note from analysts including Nikolaos Panigirtzoglou. The bank's currency strategy group for its part also prodded clients to take out some insurance, just in case another upset takes place.

Also Read: Google's antitrust legal woes are far from over if Joe Biden wins

Treasury traders are also taking a gut check. The world's biggest bond market has pulled back wagers that long-term yields rise in the wake of a unified government intent on more fiscal spending. However, some of that retreat reflects a sharp swoon in U.S. shares triggered as rising virus cases force some nations back into lockdowns.

The 10-year Treasury yield is at about 0.84% after breaking out of a range that had held since June to hit 0.87% last week.

Catch all the Latest Tech News, Mobile News, Laptop News, Gaming news, Wearables News , How To News, also keep up with us on Whatsapp channel,Twitter, Facebook, Google News, and Instagram. For our latest videos, subscribe to our YouTube channel.