GST increase for phones from 12% to 18% will crumble the industry: Xiaomi India MD

Everyone will be forced to increase prices. This will further weaken mobile industry’s #MakeInIndia program, said Xiaomi’s Manu Kumar Jain

Hiking GST on mobile phones will be detrimental for consumer sentiment and in turn impact local manufacturing, industry body ICEA said following Goods and Services Tax (GST) Council's decision to increase GST on mobile phones from 12% to 18%.

Sources: GST (Goods and Services Tax) Council has decided to increase GST on mobile phones from 12% to 18% pic.twitter.com/PzurzO0LtR

— ANI (@ANI) March 14, 2020

India Cellular and Electronics Association (ICEA) chairman Pankaj Mohindroo called this decision detrimental to the vision of Digital India and said -

"The increase of GST by 6% will be extremely detrimental to the vision of Digital India. Consumption will be stymied and our domestic consumption target of USD 80 billion (6 lakh crores) by 2025 will not be achieved. We will fall short by atleast 2 lakh crores. This was time for statesmanship especially when the country is going through a crisis and as a nation, we have fallen short".

Watch | GST on mobile phones hiked to 18% from 12%: Nirmala Sitharaman

The ICEA is the apex industry body of mobile and electronics industry comprising of manufacturers, brand owners, technology providers, VAS application and solution providers, distributors and retail chains of mobile handsets and electronics devices.

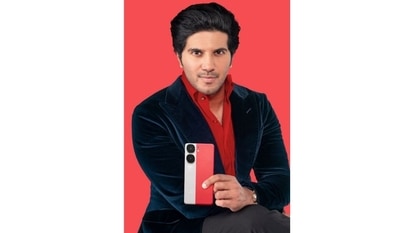

Reacting to this, Xiaomi India MD Manu Jain tweeted:

#GST increase for phones from 12% to 18% will crumble the industry.

— Manu Kumar Jain (@manukumarjain) March 14, 2020

Smartphone industry is already struggling with profitability due to depreciating INR vs US$.

Everyone will be forced to increase prices. This will further weaken mobile industry's #MakeInIndia program.

He also requested for an exemption for phones that cost less than ₹15,000 ($200) -

My humble request to Hon. PM @NarendraModi ji and FM @nsitharaman ji - please reconsider this #GST hike.🙏

— Manu Kumar Jain (@manukumarjain) March 14, 2020

The industry is already struggling with depreciating INR & supply chain disruption due to Covid-19.

At least all devices under $200 (= ₹15,000) must be exempted from this. https://t.co/hOMpSpTyKk

According to an IDC (International Data Corporation) report, the Indian smartphone market grew only by an 8% YoY in 2019, though India was still amongst a handful of top markets last year. This hike in GST is going to act as a deterrent to the growth India witnessed on the global smartphone market list.

"This doesn't bode well for the growth intended by the government for digital services. It has to start with more people coming in the smartphone fold. With these decisions that won't happen," said Navkendar Singh, Research Director, Client Devices & IPDS, at IDC India.

Also Read: GST on mobile phones raised from 12% to 18%, says Nirmala Sitharaman

"Considering the current supply and projected demand scenario in the next couple of quarters, brands are not in any position to absorb this hike. They will be forced to pass it onto the consumer, which will further increase the replacement cycle (which has been a major engine of growth in the market for the past couple of years)," Singh added speaking to TechPP.

AIMRA (All India Mobile Retailers Association) has also requested the Finance Minister not to hike the GST on mobile phones.

"An increase of 6% GST will break the crippling mobile retail industry, already burdened with low margin business in today's scenario and fighting for rightful existence. The increase of 6% would directly lead to the hike in prices of product, impacting the consumer behavior leading to a slowdown in the demand affecting the business adversely," said Arvinder Khurana, National President, AIMRA.

Earlier, Mohindroo had written a letter to the finance ministry stating that the sector is already under deep stress "because of disruption in the supply chain due to coronavirus outbreak" and therefore, a hike in GST at this point of time is inappropriate.

"We understand that one of the logic being put forward is that the industry is suffering from inverted GST! Instead of correcting this wrong by rationalising GST on parts, components and inputs of mobile phones, a bizarre move to increase GST on the final product is now being considered," ICEA Chairman Pankaj Mohindroo said in the letter to Finance Minister Nirmala Sitharaman.

The letter, sent on March 12, said "the proposal to hike GST on mobile phones is not in the interest of the consumers, trade, industry or the nation.

"Mobile Phones is the only sector that has performed under flagship 'Make In India' program of the government. Hence, any change in the GST will be detrimental to the consumer sentiment which in turn can impact domestic manufacturing activity," Mohindroo said.

"The Hon'ble Prime Minister has envisioned India to become the world's no.1 manufacturing destination for the mobile phones. And it may be difficult to achieve this vision unless the GST rate on handsets is retained at the current level of 12 per cent," Mohindroo said.

(With agency inputs)

Catch all the Latest Tech News, Mobile News, Laptop News, Gaming news, Wearables News , How To News, also keep up with us on Whatsapp channel,Twitter, Facebook, Google News, and Instagram. For our latest videos, subscribe to our YouTube channel.