Xiaomi to launch 100 Mi Homes in 2 years as company eyes offline expansion

After dominating the online segment, Xiaomi is eying the offline market. Xiaomi’s fourth Mi Home will open in Ambience Mall, Gurugram on August 19.

Xiaomi will launch 100 exclusive retail stores called 'Mi Homes' across India in two years, said the company's vice president Manu Kumar Jain on Thursday.

So far, the company has launched three Mi Homes, all in Bengaluru, and is gearing up to launch its fourth Mi Home in India on August 19. Its new Mi Home will be located in Ambience mall in Gurugram -- also its first Mi Home store in Delhi-NCR.

The move is part of Xiaomi's "aggressive plans" to tap the offline market. The company says its offline sales registered a ten-fold growth between January 2017 and July 2017, faster than its online sales. It said that 20% of its overall sales come from the offline channel. Jain said that the Mi Homes will initially be focused on the metro cities before expanding to Tier 3 and Tier 4 cities.

The company is going to increase the number of Mi Preferred Partner Stores to more than 1,500 across 30 cities in India. Currently, Xiaomi has over 600 Mi Preferred Partner Stores across 11 cities such as Delhi, Jaipur, Bangalore, Chandigarh, and Hyderabad. Xiaomi's Preferred Partnership program involves a greater presence in the retail store than other brands.

Launched earlier this year, Xiaomi's preferred partnership program had raised a few eyebrows. According to reports, Samsung had asked its retail partners across India not to sign up with Xiaomi's retail program. Samsung had also agreed to pay for the store branding in order to prevent partners from signing with Xiaomi, said a recent Economic Times report. Ironically, Xiaomi's fourth Mi Home in the Ambience mall is almost next to a Samsung store.

When asked about the company's preferred partnership program, Jain said that the company is looking at "going deeper" into the Indian market rather mimicking a "push" strategy adopted by other brands -- a vague reference to offline-focused brands like Gionee, OPPO and Vivo. Commenting on the initial challenges in the offline arena, Jain acknowledged that the partners were apprehensive about the company's preferred program before coming onboard.

From online-only model to aggressive offline model

Xiaomi had entered the Indian market in July 2014. The company initially stayed an online-exclusive brand before gradually customizing itself for the Indian market. The company forayed into India's lucrative offline market in October 2016 with the Redmi 3s Plus.

It is worth mentioning here that Xiaomi has a very strong presence in the sub-₹15,000 smartphone segment. "Xiaomi's Redmi Note 4 with over 2 million shipments in Q2, 2017 has become the highest shipped smartphone in a single quarter in the history of Indian smartphone," according to the latest data by research firm IDC.

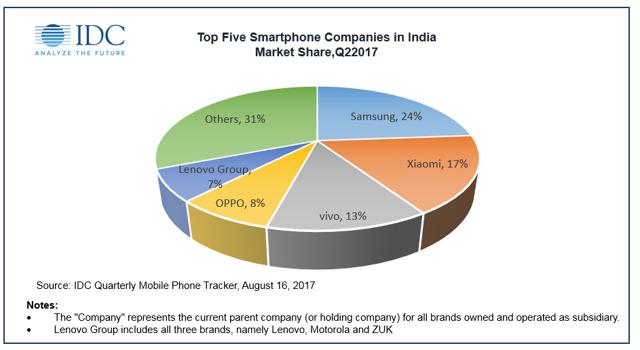

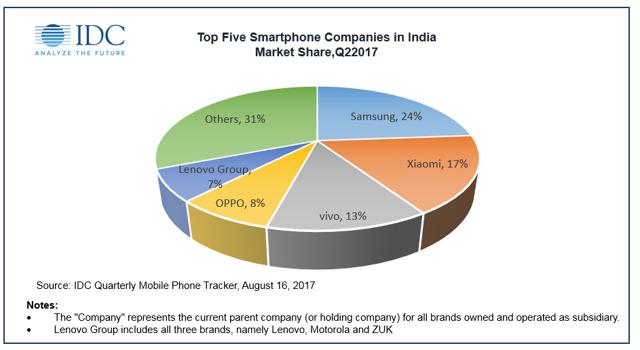

The IDC report further reveals that Xiaomi is the top online smartphone player with 46.9% market share. Overall, the company has 17.9% market share.

"Xiaomi secured second place with a healthy 25% QoQ growth in Q22017. The vendor continues to expand its offline presence with the opening of Mi homes, Mi authorised stores and partnering with the key large format retail stores. This helped Xiaomi to triple its offline shipments in the second quarter of the year," the report further says.

Xiaomi's aggressive offline focus comes at a time when rival Motorola is also stepping up its efforts to tap the offline market. Earlier this month, Motorola announced plans to launch 50 exclusive retail stores, Moto Hubs, across the country by end of this fiscal year.

It is worth noting that brands like OPPO and Vivo have quickly gained a relatively large market share in the country by just focusing on the offline model. According to the IDC data, Vivo stood at the 3rd position in the second quarter of 2017 with 13% market share. OPPO, in the meanwhile, stood at the fifth position with 8% market share.

Parv Sharma, an analyst at Counterpoint Research, told Hindustan Times, "Offline market is mostly dominated by Samsung, Vivo and Oppo. Xiaomi has recently started expanding in offline market through its own stores and looking to expand its presence."

"With most of the brands diversifying and pushing for multi-platform strategy to target new users, Xiaomi in such a scenario can't afford to be behind its competitors especially when it has a strong momentum. Moreover, a strong offline presence will help Xiaomi to understand the changing consumer preferences through direct interaction and also impact the sale of its other products beyond smartphones. As far as challenges are concerned, maintaining a price parity in offline space will be crucial to ensure the commitment of retailers," he elaborated.

"With increasing Chinese players expanding their presence across India , the incumbent players will feel the competition and that might impact the overall margin levels in supply chain. Chinese brands can lead to even more dynamic and competitive margins," he added.

Catch all the Latest Tech News, Mobile News, Laptop News, Gaming news, Wearables News , How To News, also keep up with us on Whatsapp channel,Twitter, Facebook, Google News, and Instagram. For our latest videos, subscribe to our YouTube channel.