Filed Income Tax Returns? Know how to e-Verify ITR through Aadhaar OTP

Taxpayers can e-Verify their Income Tax Returns (ITR) through Aadhaar OTP in order to complete the process. Here is how.

Every individual who is earning needs to file Income Tax Returns (ITR) as it is a form which reports their annual income to the Income-Tax department. The form enables you or any taxpayer to declare your income, expenses, tax deductions, investments, among others. The due date for filing Income Tax Returns (ITR) for AY 2021-22 is nearing and those who have not filed can know that the last day to file the returns is December 31, 2021. IT can be filed in two modes - offline and online. The facility of electronic filing (e-filing) of an income tax return is being provided by the Income Tax Department.

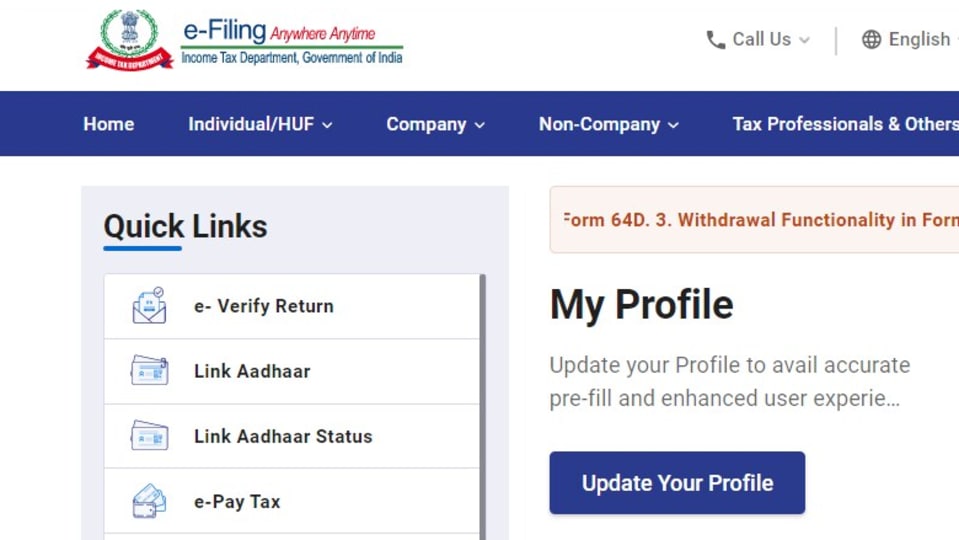

After filing the ITR, you need to e-verify it in order to complete the return filing process. As per the information provided by the Income tax Department, without verification within the stipulated time, an ITR is treated as invalid. e-Verification is the most convenient and instant way to verify your ITR. The e-Verify service is available to both registered and unregistered users on the e-Filing portal.

You can e-Verify your Income Tax Return using any of the several modes available. The modes available for e-Verification includes: Digital Signature Certificate, Aadhaar OTP, Electronic Verification Code (using bank account / demat account), Electronic Verification Code (using Bank ATM - offline method) and Net Banking.

If you have filed your ITR and want to e-verify it through Aadhaar OTP, then you need to ensure that your mobile number is linked to Aadhaar. Also, ensure that your PAN is linked with your Aadhaar number.

How to e-verify ITR through Aadhaar OTP:

|

|

|

|

| 20 Minutes |

|

|

Catch all the Latest Tech News, Mobile News, Laptop News, Gaming news, Wearables News , How To News, also keep up with us on Whatsapp channel,Twitter, Facebook, Google News, and Instagram. For our latest videos, subscribe to our YouTube channel.