BSE portal gets tech ready to launch electronic gold receipts

The idea behind BSE's step to launch electronic gold receipts is to give investors in India a transparent domestic spot price discovery mechanism.

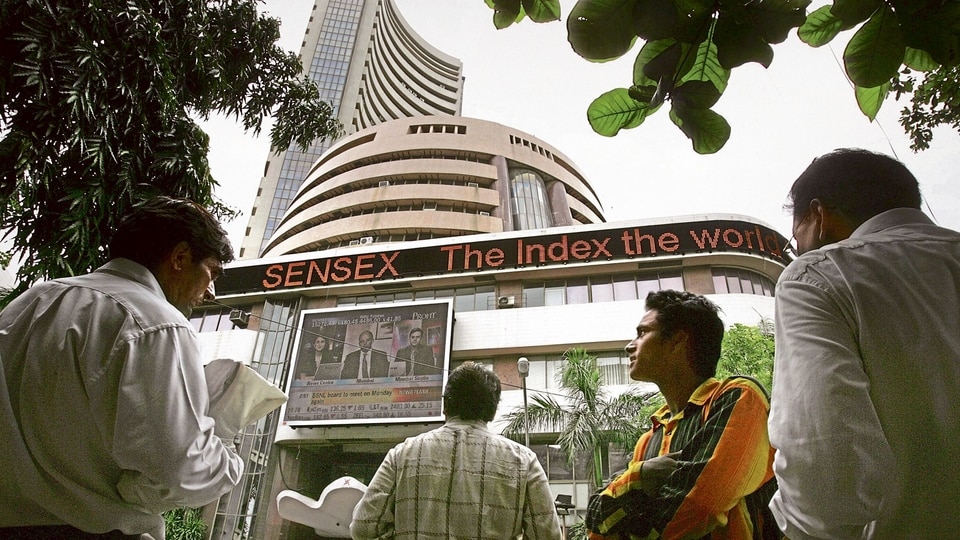

The Bombay Stock Exchange (BSE) is all set to launch electronic gold receipts (EGRs) on its platform. The technology for the same has been readied. This will help in creating a uniform gold price structure across India, revealed Sameer Patil, its chief business officer on Sunday. Trading in EGRs will contribute to the existing programs for gold monetization such as Gold Monetization Scheme (GMS), Gold Bonds and Gold Deposits. While the tech is ready, BSE needs to take the required internal approvals and apply to Sebi for permission to launch the new class of security on its platform, he added. Notably, the Sebi board Tuesday last had cleared a proposal for gold exchange, wherein the yellow metal will be traded in the form of EGRs. The idea behind it is to give investors in India a transparent domestic spot price discovery mechanism.

Currently, India allows trading only in gold derivatives and Gold ETFs, unlike several other countries which have spot exchanges for physical trade in gold. The instruments representing gold will be called Electronic Gold Receipts (EGRs) and it will be notified as securities. EGRs will have trading, clearing and settlement features akin to other securities that are currently available in India, PTI revealed.

Also read: Looking for a smartphone? Check Mobile Finder here.

"BSE, which is well known for its technological prowess, has been the main proponent of creating a transparent and efficient spot market for gold as it is very important commodity for Indian consumers," Patil said.

Patil said that, like shares, these EGRs will be held in demat form and can be converted into physical gold when needed. To enable trading in physical gold, EGRs (backed by physical gold) will be traded and settled on stock exchanges. Patil said that the entire trading will be done in three tranches that include conversion from physical gold to EGRs, trading of EGRs and again conversion of EGR back to physical gold.

To begin with, BSE may plan to launch EGR of 1 kg and 100 gm denominations and the same can be converted to physical gold. To attract retail investors, EGR with smaller denominations of 50 gm, 10 gm and 5 gm will also be launched in a phased manner.

The source of supply of the physical gold to be converted into EGR will be the fresh deposit of gold, coming into the vaults, either through imports or through stock exchanges accredited domestic refineries. A client can also convert physical gold to EGR by depositing physical gold at the designated delivery centre. Exchanges will empanel Vault Service Providers (VSPs) based on guidelines prescribed by Sebi.

The move is expected to reduce the existing market inefficiencies that exist in bullion trade and may act as a bridge in integrating spot gold trade with derivatives markets and create a transparent platform for bullion trading.

Catch all the Latest Tech News, Mobile News, Laptop News, Gaming news, Wearables News , How To News, also keep up with us on Whatsapp channel,Twitter, Facebook, Google News, and Instagram. For our latest videos, subscribe to our YouTube channel.