The critical need for India to be self-reliant in semiconductors

India has for long relied heavily on China and the US for both heavy and precision industry raw materials, technology, finished, and intermediary goods. It's time that changed.

The pandemic is altering the contours of global trade and policymaking as per the emerging threats, opportunities, and public sentiment. The global realisation of a self-reliant economy is a consequence of Covid-induced lockdowns, restricted mobility, low production, and supply chain irregularities, which impelled the government to look for domestic alternatives.

India has for long relied heavily on China and the US for both heavy and precision industry raw materials, technology, finished and intermediary goods. In December 2020, India encountered an alarming supply shortage of microprocessors or semiconductors due to lockdown and restricted imports affecting industrial production. This sparked the initiative of building a self-sufficient semiconductor market.

Establishing a robust semiconductor economy

It is the turn of Cloud & IoT-based solutions to go the extra mile to simplify complex business processes and also elevate the customer experience. The advent and growth of the cloud have dramatically made the stage ready & mature for wireless connectivity to flourish.

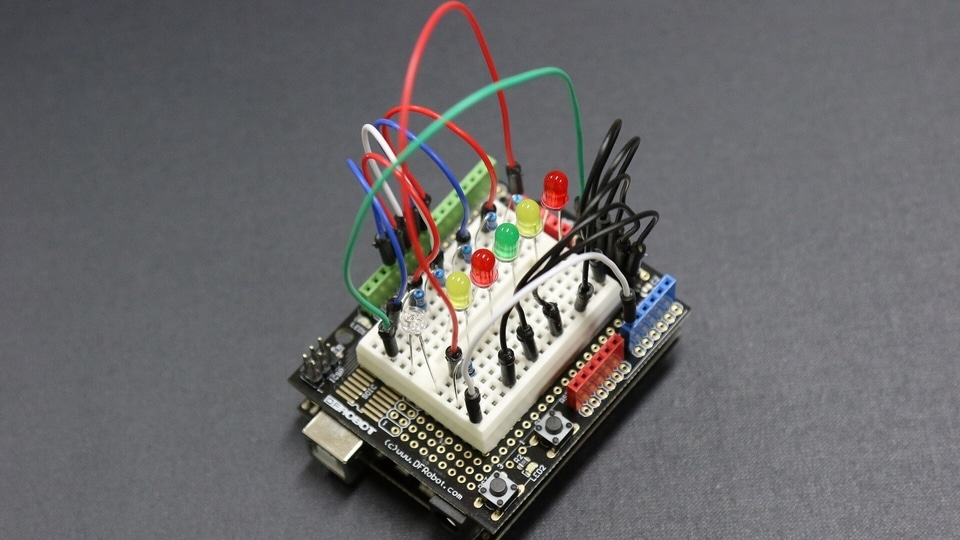

'SMART connected devices' are now becoming ubiquitous. At the center of this revolution are the semiconductors which take on the responsibility of running the logic that needs to perform all the magic and with every passing six-month cycle, with extremely fast product life cycles and customer demands, the world of semiconductors is getting sophisticated for good. Sophistication in terms of the functional capability of these ICs and the infrastructure required to roll them out like hotcakes, for the countless product makers and OEMs all around the globe.

Embedded electronics products are built of primary components that include ICs for computing, connectivity, or memory storage, and discrete components like resistors, capacitors, and the likes. An electronic product consists 60% of discrete components and 40% of primary components. The growth of electronics manufacturing systems is impacted by the price & availability of the discrete components. The IoT product makers/Electronic product OEMs from India are still majorly dependent on imports for the discretes.

Despite emerging as an embedded design house, India hasn't been able to promote the manufacturing of discretes or being an important pivot in the value chain. The stark difference in the growth of India's Electronic manufacturing & Assembly Services sector compared to China is the reason. As of 2021, rough estimates suggest that around 700-800 EMS companies are operating in India while Shenzhen alone has more than 800 players.

India's IoT market is expected to grow with a CAGR of approximately 21.9% between 2019-2025. The IoT market's current size is estimated at 15 billion. With high growth potential and consumption estimates, the demand for the structured domestic semiconductor industry is crucial.

What other countries are doing right

China, the US, South Korea, and Japan have become formidable exporters of the primary components market which have the deep technology expertise and patents to develop the chipset, processor, and controller side. However, China has adopted an intelligent strategy to become the leader at the other end of the turf.

China and Taiwan have invested heavily in EMS which helped them achieve significant economies along with production optimization techniques that have enabled them to benchmark quality standards, thus the manufacturing backyard of the world.

In 2020, China's semiconductor firms recorded cash flow at RMB 227.6 billion ($35.2 billion) from the primary and secondary markets, a stunning 407% increase from the previous year, according to TechNode's research. Taiwan Semiconductor Manufacturing Company (TSMC) is the undisputed leader of the global semiconductor foundry business accounting for more than 50% of the worldwide market.

Favorable policies towards digitization adopted by these states have had a waterfall effect, i.e., easy and fast access to financing of electronic manufacturing facilities. In hindsight - a robust electronic manufacturing & assembly industry with a local supply of discrete components has resulted in great prices, exemptions on duties, easy supply and logistics, and a faster go-to-market for OEMs relying on Chinese or Taiwanese ecosystem partners.

What can India do

Large-scale government efforts are needed to establish a scalable semiconductor economy that can satisfy India's domestic demands. The government is keen to incentivize as well as attract investment in establishing Semiconductor FABs. It is also endeavoring to increase India's global manufacturing of mobile phones, IoT, automotive, medical and industrial electronics to achieve $400 billion worth of electronics manufacturing by 2025.

Support for IoT-based Startups in India and also providing them adequate infrastructure, funding, and a world-class environment is essential to promote research and development. This will help local companies in manufacturing components. Other industries based in India can enter into partnerships with these companies or startups for providing them with raw materials and essential components for their use. Thus we can have a self-sustaining domestic model.

The Government and PSUs can directly procure semiconductors from local manufacturers without having to depend on imports.

This article has been written by Ajit Thomas, Co-founder and CMO, Cavli Wireless Inc.

Catch all the Latest Tech News, Mobile News, Laptop News, Gaming news, Wearables News , How To News, also keep up with us on Whatsapp channel,Twitter, Facebook, Google News, and Instagram. For our latest videos, subscribe to our YouTube channel.