Union Budget 2021: Widespread feeling of disappointment in the proposals of duty hikes, says ICEA

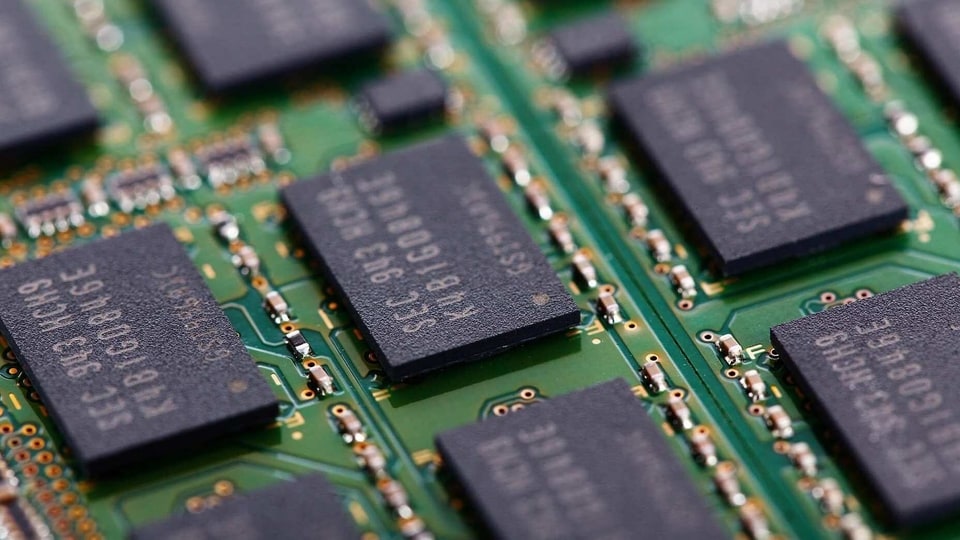

Duty on parts used in manufacturing PCBA and camera modules has been increased to 2.5% from NIL starting April 1, 2021.

Union finance minister Nirmala Sitharaman on Monday announced the Union Budget for the financial year 2021-22. In the new budget, the union government has proposed raising the import duty on several electronic items including mobile phone parts, auto parts and solar items.

For instance, duty on parts used in manufacturing PCBA and camera modules has been increased to 2.5% from NIL starting April 1, 2021. Camera lenses, however, have been excluded from the list of parts and will attract customs duty as per the tariff heading.

Similarly, duty on sub-parts for manufacturing connectors has been increased to 2.5% from NIL. It now includes only raw materials of wired headsets, USB cable, microphone receiver, main lens, GSM antenna, mylar for LCD/FPC, figure print reader and scanner. Rest of the parts have been withdrawn from the entry.

The union government has also revised duty on PCBA and moulded plastic for chargers. The duty on PCBA and moulded plastic for the manufacture of the charger has been increased from 10% to 15%. Inputs and parts (other than PCBA and moulded plastic) of the mobile charger has been increased to 10% from NIL.

Responding to the development, Indian Cellular & Electronics Association (ICEA) said that there is a widespread feeling of disappointment in the proposals of duty hikes.

“There is a widespread feeling of disappointment in the proposals of duty hikes in notifications 50/2017 and 57/2017 which have been scaled up from zero to 2.5% and 10% to 15% in some cases. In some cases, like mechanics this will be a big setback and can collapse the developing mechanics industry vertical,” ICEA said.

The industry body also said that the ‘manufacture of intermediate goods between raw-material and final products may also be affected due to increase in costs, the domestic manufacturing can have a setback in the short run'.

“On the GST front, the industry is disappointed on the non-reversal of tax from 18% to 12%...On the income tax side, there is no movement on special concessions to the electronic industry,” ICEA added.

Catch all the Latest Tech News, Mobile News, Laptop News, Gaming news, Wearables News , How To News, also keep up with us on Whatsapp channel,Twitter, Facebook, Google News, and Instagram. For our latest videos, subscribe to our YouTube channel.