Facebook deflates any thought of tech bubble

The horrendous stock market debut for Facebook suggests investors are not ready to jump in and create another tech bubble despite big expectations for social media, analysts say. Not on friend's list

The horrendous stock market debut for Facebook suggests investors are not ready to jump in and create another tech bubble despite big expectations for social media, analysts say.

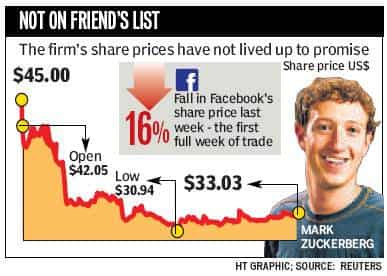

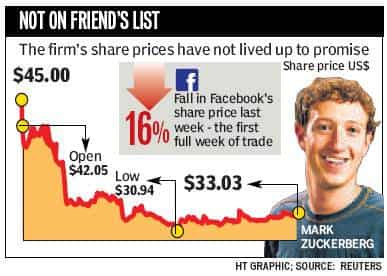

Facebook closed out its first full week of trade with a loss of 16% from its offering price of $38, in a huge disappointment after a much-hyped initial public offering worth $16 billion, the biggest for a tech firm.

'When you see Facebook share prices tank, it does get people back on to a more foundational basis, in terms of real revenues, real profits,' said Nick Landell-Mills at Indigo Equity Research.

Mark Heesen, president of the National Venture Capital Association, said investors are being more cautious than during the tech bubble of the late 1990s. 'This is by no means the end of social media. It is going to continue to grow and expand.'

But he said that during the tech bubble, 'venture capitalists invested $150 billion in two years. In the last two years we invested about $60 billion. There is much, much less money in the system right now. That's critically important.'

Gerard Hoberg, professor of finance at the University of Maryland, said he does not expect a new bubble, given today's market sentiment. 'I think it's very healthy and I think people learned the lessons from the 1990s. It's preventing a bubble from forming.'

Facebook appeared to be the driving force in a surge into social media. But some of its social media brethren are also being watched cautiously.

Zynga, the social gaming website which has strong ties with Facebook, has lost some 35%, and the online deals firm Groupon has slid nearly 40%. But the professional social network LinkedIn has doubled in a year since its IPO.

The mixed reaction to these IPOs has taken some of the froth out of the market, said Heesen. 'If Facebook languishes, that does send a signal to others (tech firms) that maybe going public is not the best option — maybe getting acquired or trying to wait out this volatile period is better.'

Catch all the Latest Tech News, Mobile News, Laptop News, Gaming news, Wearables News , How To News, also keep up with us on Whatsapp channel,Twitter, Facebook, Google News, and Instagram. For our latest videos, subscribe to our YouTube channel.