Paytm among world fintechs to show highest gross profit growth while keeping expenses under control, says report

This showcases Paytm’s ability to scale its business rapidly while optimizing resources

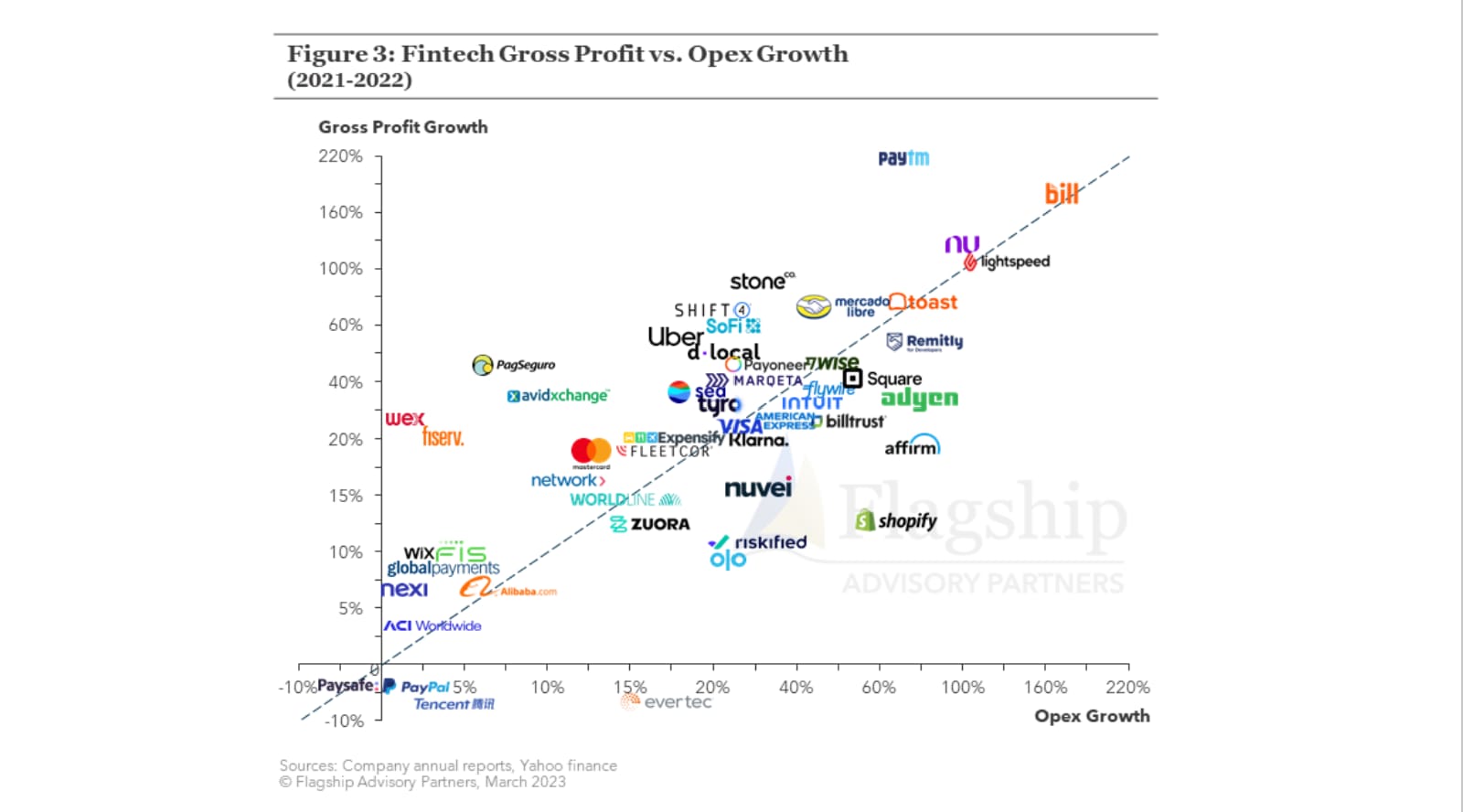

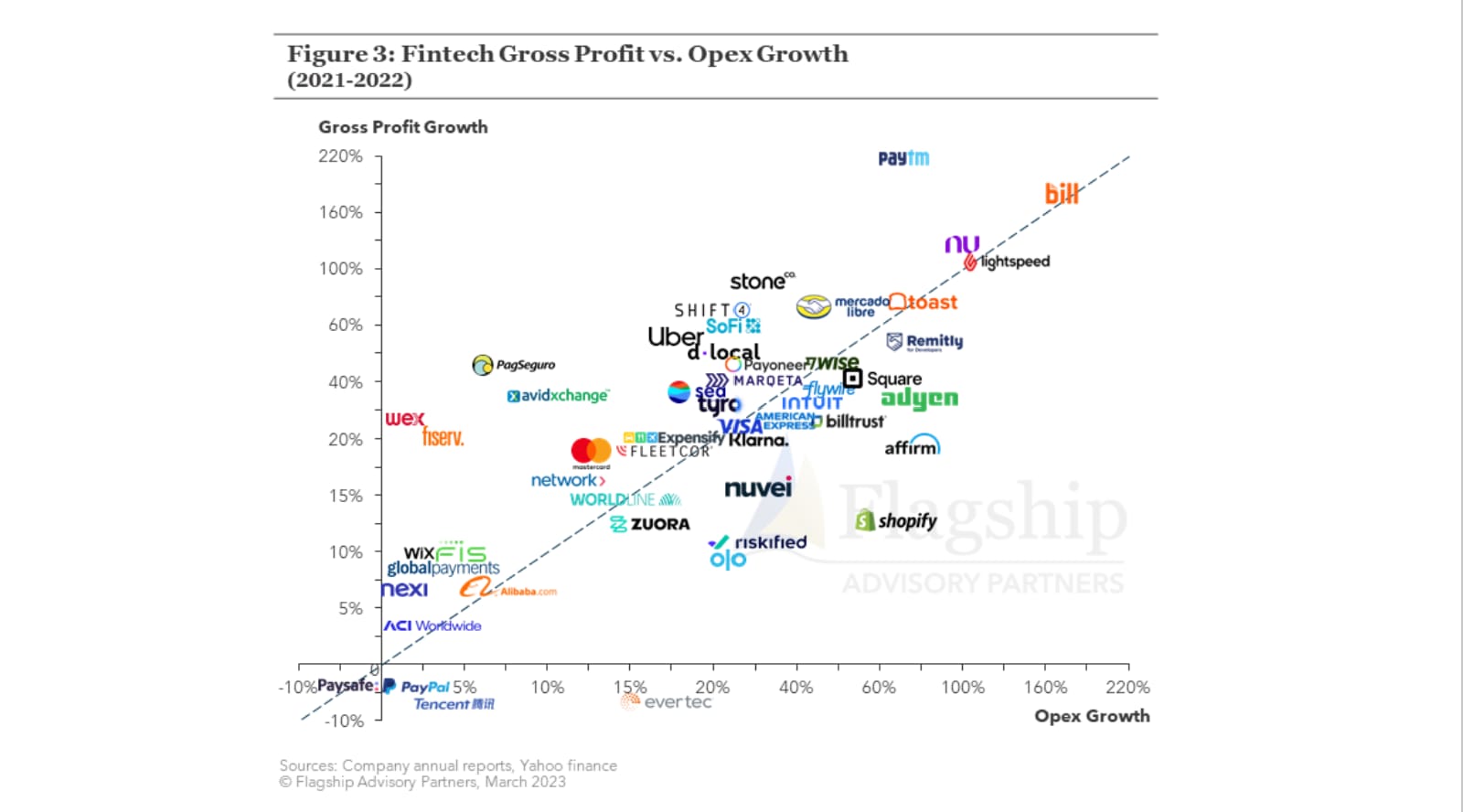

India's QR and mobile payments pioneer Paytm is among some of the fintech companies worldwide to record the highest growth in gross profit while also keeping expenses in check, according to a report by Dutch payments consultancy Flagship Advisory Partners.

The report highlights that Paytm's gross profit saw an impressive growth of over 200% between 2021 and 2022, while its operating expenses only increased by 60%.

Paytm was among the few global companies to witness gross profit growth outpacing operating expense growth. This showcases Paytm's ability to scale its business rapidly while optimizing resources.

— Vijay Shekhar Sharma (@vijayshekhar) April 7, 2023

Paytm Founder and CEO Vijay Shekhar Sharma also reacted to the report. He recently said in the company's Q3 earnings call said the focus on monetization in the last two years has allowed Paytm to make continuous investments in growth while improving profitability, adding that the trend of generating sustained profit will continue.

The company had said it continues to make investments in areas where it sees attractive growth and monetization opportunities. This includes investing in marketing for user acquisition, and in sales teams to increase the merchant base and subscription services.

Paytm's indirect expenses (excluding ESOP cost) have remained flat over the past three quarters and were ₹1,016 crore in the quarter, growing 20% YoY. Indirect expenses as a percentage of revenue have come down to 49% in Q3 compared to 59% of revenue a year ago.

Meanwhile, the company's revenue increased by 42% in Q3 to ₹2,062 crore, despite no UPI incentive being recorded during the quarter.

As Paytm sharpened its focus on achieving growth with quality revenues that contribute to profitability, it recorded an operating profit for the first time in Q3 which was three quarters ahead of guidance. Paytm's EBITDA before ESOP cost stood at ₹31 crore, an improvement of ₹424 crore year-on-year.

Sharma had said this milestone was reached without losing sight of growth opportunities and keeping all compliances as well as risk factors under a strict watch.

According to Paytm's operating performance update for Q4 FY23, its average monthly transacting users (MTU) surged by 27% to 90 million during the quarter. It strengthened its leadership in offline payments with 6.8 million devices deployed, an increase of 1.0 million in the quarter.

Catch all the Latest Tech News, Mobile News, Laptop News, Gaming news, Wearables News , How To News, also keep up with us on Whatsapp channel,Twitter, Facebook, Google News, and Instagram. For our latest videos, subscribe to our YouTube channel.