Paytm Q4: Fintech Giant Reports Revenue of ₹2,334 cr

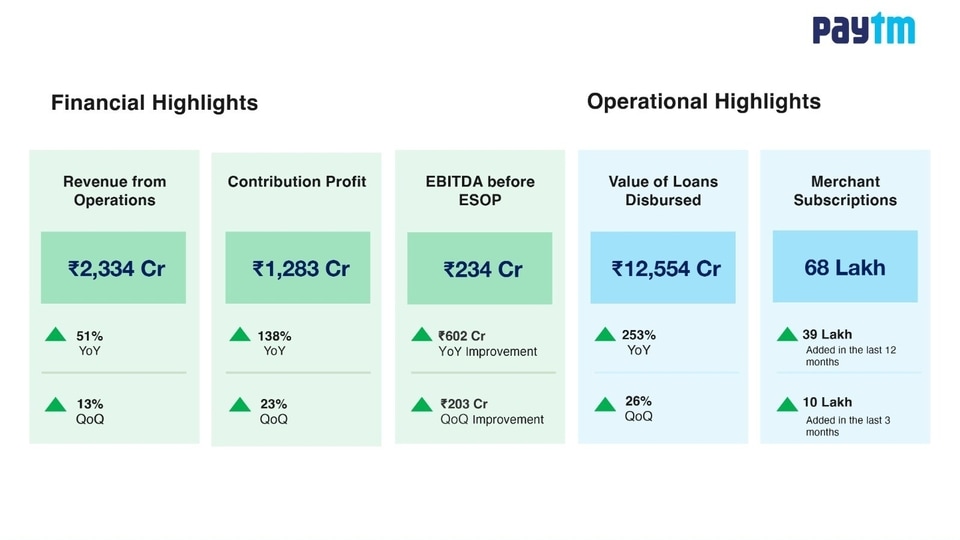

The company’s consolidated revenue from operations rose 51% to ₹2,334 crore in Q4FY2023, compared with consensus estimates of ₹2,305 crore

Paytm, India's leading mobile payments and financial services provider, on Friday reported fourth-quarter revenue that beat analysts' estimates. The company's consolidated revenue from operations rose 51% to ₹2,334 crore in Q4FY2023, compared with consensus estimates of ₹2,305 crore.

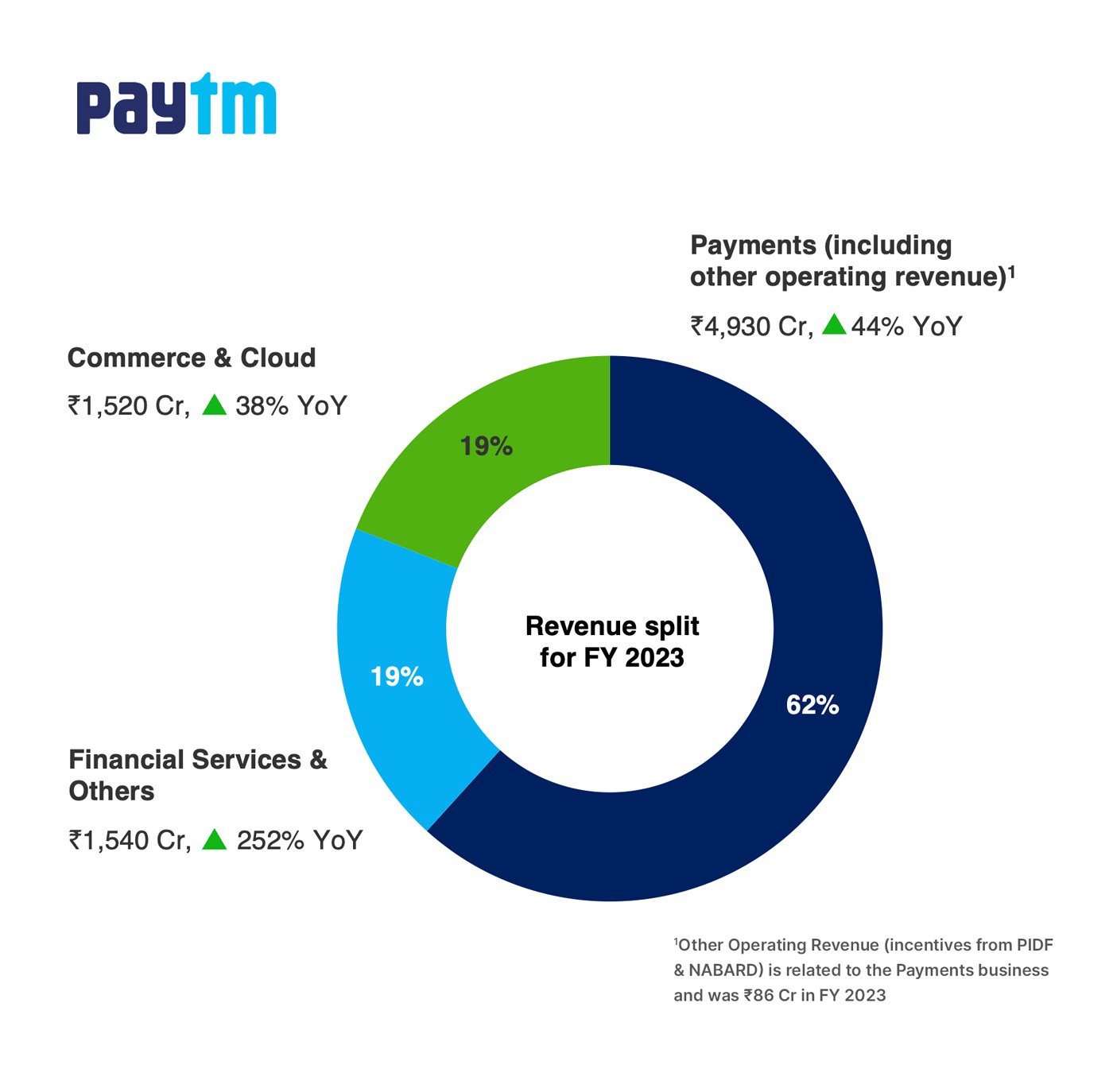

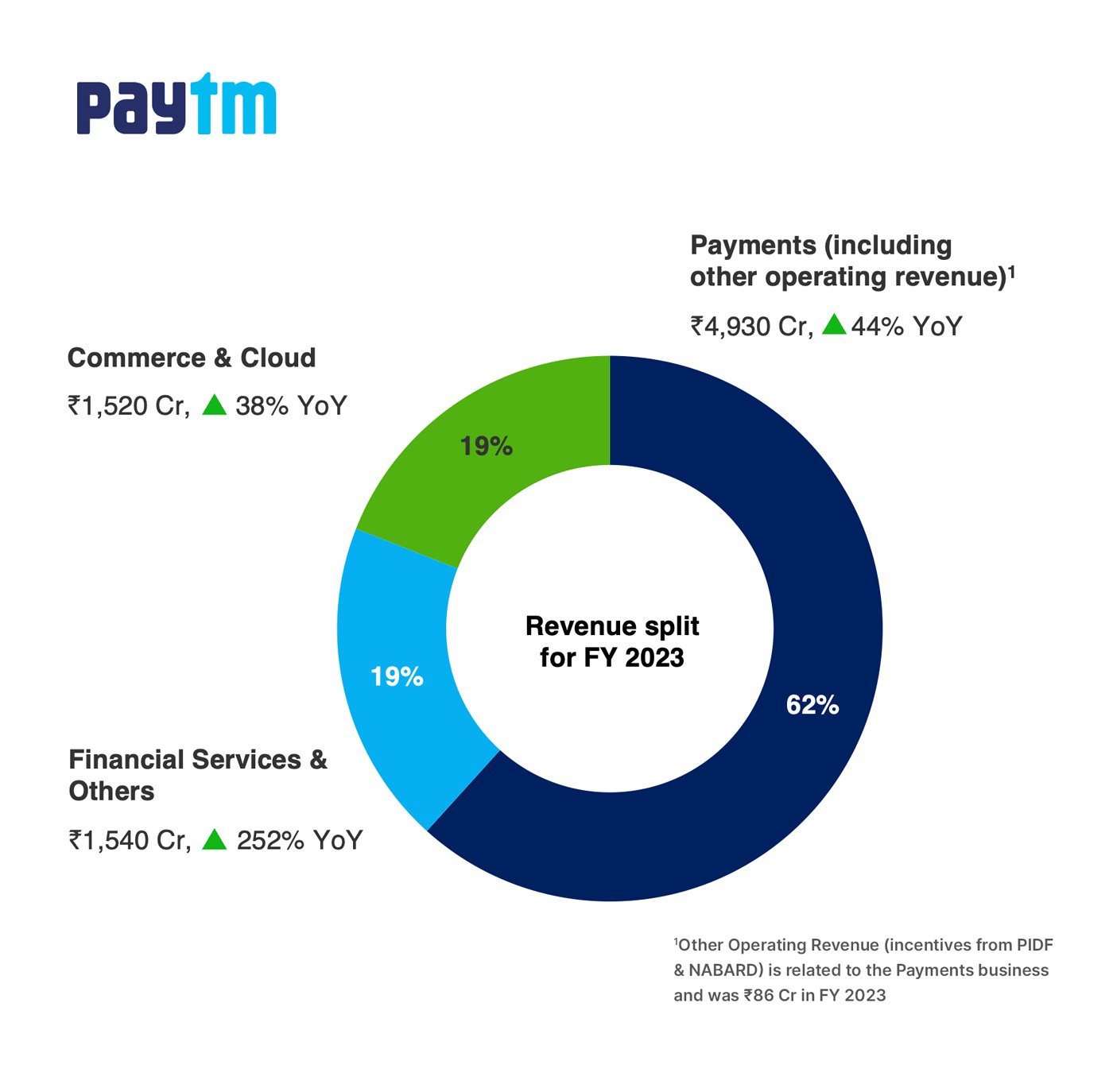

The company's operating profit, measured by EBITDA before ESOP cost, was ₹234 crore in Q4 beating analyst estimates of ₹144 crore. For the full fiscal year, the company's posted a massive revenue of ₹7,990 crore, an increase of 61% YoY.

Paytm's EBITDA before ESOP during Q4, excluding prior quarters' UPI incentives, was ₹101 crore, compared to ( ₹368) crore in Q4 FY2022.

Paytm's payments revenue grew by 41% YoY to ₹1,467 crore in Q4FY23, with payment revenue growing 28% YoY after excluding prior quarters' UPI incentives. The company's payment profitability improved with the Q4FY23 net payment margin expanding 158% YoY to reach ₹687 crore. In FY23, the net payments margin grew by an impressive 2.9X to ₹1,970 crore, demonstrating the profitability of the payment business, despite the higher share of UPI.

Paytm achieved its operating profitability milestone in Q3, ahead of its September 2024 guidance, due to the increased pace of monetization, better cost management, and higher operating leverage. In Q4, Paytm's EBITDA before ESOP costs, excluding UPI incentives, rose to ₹101 crore, a significant improvement from the previous year's Q4 figure of ( ₹368) crore.

Paytm's contribution margin stood at 55%, driven by the continued improvement in payments profitability and increasing mix of high-margin businesses like credit distribution. Contribution profit margin improved from 30% in FY22 to 49% in FY23 of revenue to ₹3,900 crore, up 160% YoY. Excluding prior quarters' UPI incentives, the like-for-like margin increased to 52% from 35% in Q4FY22.

Paytm's user engagement on the platform continues to grow, with average Monthly Transacting Users (MTU) for Q4FY23 increasing by 27% YoY to 9 crore, indicating a growing adoption of digital payments by consumers and merchants in India. The company's Gross Merchandise Value (GMV) increased by 55% YoY to reach ₹13.2 lakh crore for FY23.

Paytm's loan distribution business, in partnership with marquee lenders, has continued to scale, with the total number of loans growing to 1.2 crore in Q4FY23, up 82% YoY, and the total value of loans amounting to ₹12,554 crore, registering a growth of 253% YoY.

Paytm's subscription revenues continue to grow, with 6.8 million merchants paying for device subscriptions, almost doubling its growth YoY by 3.9 million. The company's focus on creating additional payment monetization is paying off, and it expects the momentum on the growth and profitability across its diverse businesses to continue in the next fiscal year.

Paytm has made significant investments in sales, manpower, and technology platform improvement, and it's paying off in the form of strong financial performance. The company's efforts to improve payment profitability are bearing fruit, with the net payment margin expanding by a substantial margin. The loan distribution business is also performing well, with an increasing number of borrowers using Paytm's platform to avail of loans.

The company's credit distribution business is showing strong growth, with high-margin businesses contributing to an improvement in contribution margin. The company's GMV is growing steadily, indicating the growing adoption of digital payments by consumers and merchants in India.

Paytm's focus on creating additional payment monetization, coupled with its investments in sales, manpower, and technology platform improvement, bodes well for its future growth and profitability.

Catch all the Latest Tech News, Mobile News, Laptop News, Gaming news, Wearables News , How To News, also keep up with us on Whatsapp channel,Twitter, Facebook, Google News, and Instagram. For our latest videos, subscribe to our YouTube channel.