Tesla’s Brutal Year Brings $17 Billion Windfall for Shorts

After years of stinging losses, investors betting against Tesla Inc. are finally reaping the windfall they’ve been expecting.

View all Images

View all ImagesAfter years of stinging losses, investors betting against Tesla Inc. are finally reaping the windfall they've been expecting.

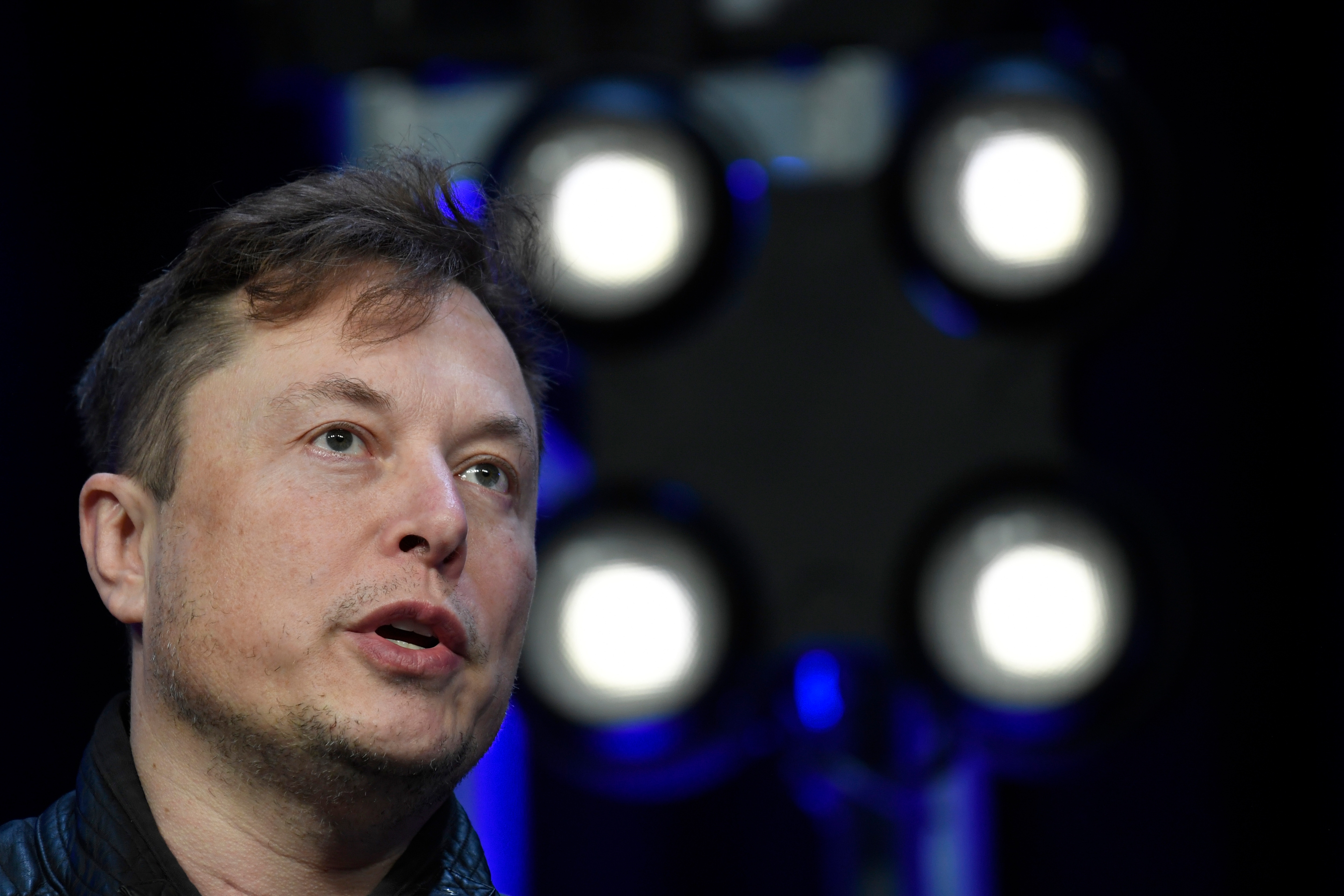

With Chief Executive Officer Elon Musk — and some of his top lieutenants — distracted by his Twitter foray and demand for Tesla's electric vehicles cooling, the stock is careening toward its worst annual slump on record. This is handing short sellers, or bearish investors who are wagering that the stock will decline, mark-to-market profits of about $17 billion, making Tesla the most profitable short trade of the year, data from S3 Partners shows.

Tesla has tumbled more than 40% in December alone, extending its decline to about 68% this year and wiping out over $680 billion in market value. This marks a radical about-face for a stock that was one of the great winners of the pandemic, having surged more than 740% in 2020 on the back of booming demand and rock-bottom interest rates.

2022's 89% return is a rare victory for the shorts, who had once amassed a huge bet against Tesla and its lofty valuation. At one point in 2018, more than one third of the stock's entire free float was held short. High-profile financiers such as Jim Chanos, David Einhorn and Andrew Left were among those who had piled in.

This infuriated Musk. He vowed to “burn” the shorts and even sold merchandise — a pair of limited edition satin shorts for “Only $69.420” — to mock them as Tesla prices soared. As the Tesla rally quickened, most short sellers re-examined their bets. Today, only about 2.9% of Tesla's free float is currently held short, according to S3 data.

S3's Ihor Dusaniwsky expects short selling to persist until the stock reaches a bottom. But analysts and investors are still struggling to see a bottom, especially as the company is due to report fourth-quarter delivery numbers early next month and has been offering large buyer incentives.

Tesla shares rose as much as 9.6% to $123.57 in New York on Thursday for the second straight day of gains, showing some signs of relief after a seven-day losing streak dragged it down 31%. If the advance holds through the end of the session, it will the stock's first back-to-back days in green since early December.

Late on Wednesday, Morgan Stanley analyst Adam Jonas, who has had the equivalent of a buy rating on the stock since November 2020, said there is an “attractive entry for investors” amid the steep slide in the share price. Jonas cut his price target on Tesla to reflect lower pricing and reduced valuation of the company's businesses, but said he expected the company to extend its lead over the EV competition in 2023.

But even if share price begins to recover from here, Tesla's notorious volatility could continue to linger, according to S3's Dusaniwsky.

“When Tesla's stock begins to tick upwards, there should be a flurry of short covering which will help boost its stock price higher and quicker as shorter-term short sellers look to realize their outsized mark-to-market profits before they evaporate,” he said.

Catch all the Latest Tech News, Mobile News, Laptop News, Gaming news, Wearables News , How To News, also keep up with us on Whatsapp channel,Twitter, Facebook, Google News, and Instagram. For our latest videos, subscribe to our YouTube channel.