Wall Street Says This Is Microsoft's Big Year

While other Big Tech firms buckle down on efficiency, Microsoft CEO Satya Nadella gets license to go full steam ahead. It’s all thanks to AI.

View all Images

View all ImagesWhen he was running Amazon.com Inc., Jeff Bezos, in no small part thanks to his background on Wall Street, had a knack of being able to talk investors into forgoing profit in favor of aggressive spending on expansion. If you weren't prepared to go after the big ideas, Bezos convinced them, then what was the point?

Today, the chief Wall Street whisperer isn't at Amazon, he's at Microsoft Corp. Against a backdrop of belt-tightening across Silicon Valley, where obsession over growth has given way to demands to cut costs, the Washington state-based company, led by slick visionary Satya Nadella, has been granted special license to go full steam ahead.

It's all thanks to the unbridled excitement around artificial intelligence, and Microsoft's perceived leadership in the field thanks to its $10 billion investment in OpenAI. “The Street recognizes AI is not just hype,” Wedbush analyst Daniel Ives told me, arguing Microsoft would get a longer leash to spend this year than its peers.

This mood has allowed Microsoft to be something of an outlier in this week's crop of Big Tech earnings, with Wall Street looking closely at the first hard numbers that could speak to what Meta Platforms Inc. CEO Mark Zuckerberg stated would be a “year of efficiency.”

The early signs show that, yes, Silicon Valley is learning to cut back. But although all four Big Tech companies that reported this week saw their shares rise, it was only Microsoft — not Meta, Amazon, nor Google-owner Alphabet Inc. — that did so on the basis of building exciting new technology rather than protecting existing successes.

Meta has seen the biggest share price gain, up an enormous 98% on the start of the year at the time of writing. It continues a rally that began in October 2022, when it became clear Zuckerberg was ready to make deep cuts to his workforce and ease back on his cherished metaverse vision.

A revival in Meta's digital ads business gave hope that its business model is in better shape than had been feared. But it was Zuckerberg's belt-tightening that wooed investors most, noted research firm MoffettNathanson. “The reduction in operating costs since the end of October is shocking and ultimately the key that lifted the stock to current levels,” its analysts wrote.

Meta revised its guidance for full-year expenses this year to between $81 billion and $87 billion, down from earlier projections of $94 billion to $99 billion. The number of Meta employees has fallen to 77,114, its lowest headcount since the end of 2021 and down 12% on its peak last year.

Amazon was similarly rewarded as it went about unwinding its exuberant lockdown-era expansion of its logistics network. Its workforce was down 10% on the same period last year, having eliminated 27,000 corporate employees and letting natural attrition in its warehouses take its course.

The company handsomely beat analysts' estimates on overall operating income, with the cost savings most noticeable in its North American retail business, which saw operating income of $0.9 billion in the quarter, compared to a $1.6 billion loss in the same period last year. Continued concerns over cloud growth held Amazon's stock back from bigger gains — but it is still up 31% on the start of 2023.

Alphabet saw the slimmest gains from the week, with concern over the fragility of its ad business and worries that it is becoming an also-ran in cloud computing compared with Microsoft and Amazon. Margin improvements have been harder to come by so far as Alphabet has sought to slim itself down. Logistical costs of office closures and other related expenses were in part to blame for operating income being down 13%, year-on-year.

Google Cloud's first quarter of profitability came thanks to simply shifting some of its costs to a different part of the income statement. Headcount has also never been higher — though the company pointed out that its workforce reductions would be recorded mostly in this current quarter and it was “meaningfully slowing” hiring. Alphabet has underperformed against all of its Big Tech peers so far this year, up only 22% on the start of 2023.

Meanwhile, at Microsoft, what might have been troubling metrics for other companies have been largely overlooked. Its headcount — up 9% year-on-year, despite 10,000 job cuts — doesn't suggest much in the way of scaling back. In the January-March quarter, operating margins were up marginally on the same period last year, but would have in fact decreased had it not been for an accounting change. Operating expenses increased 7%.

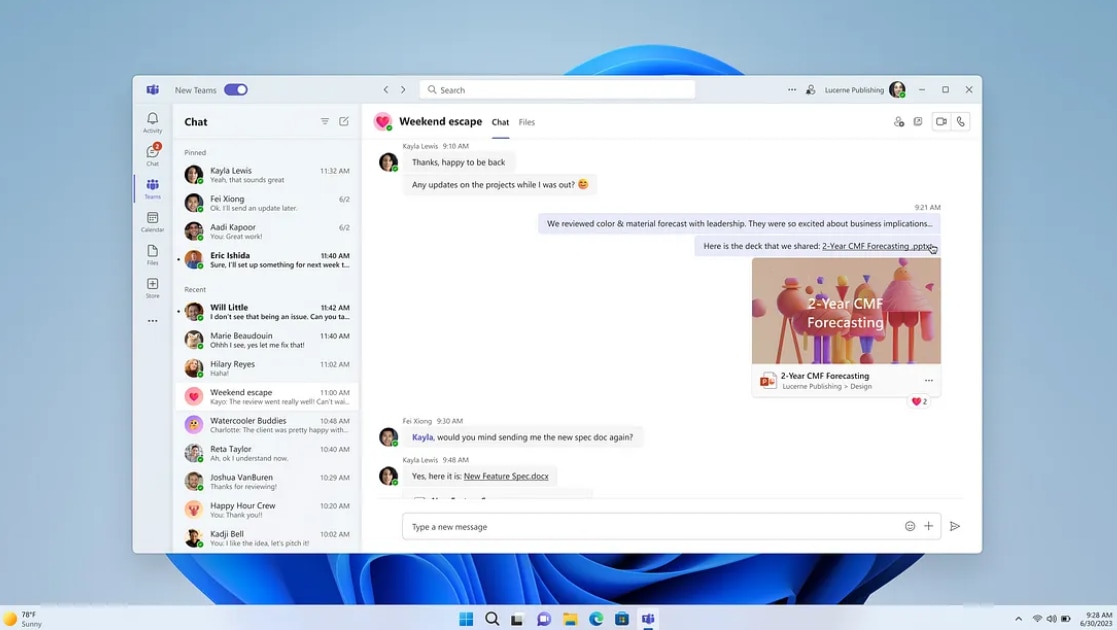

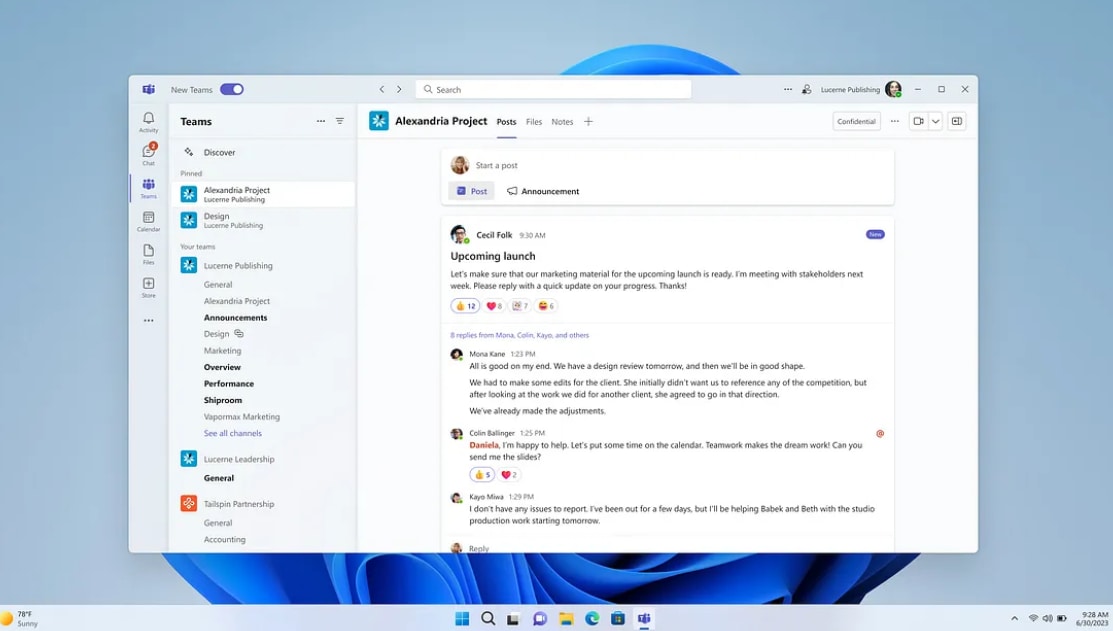

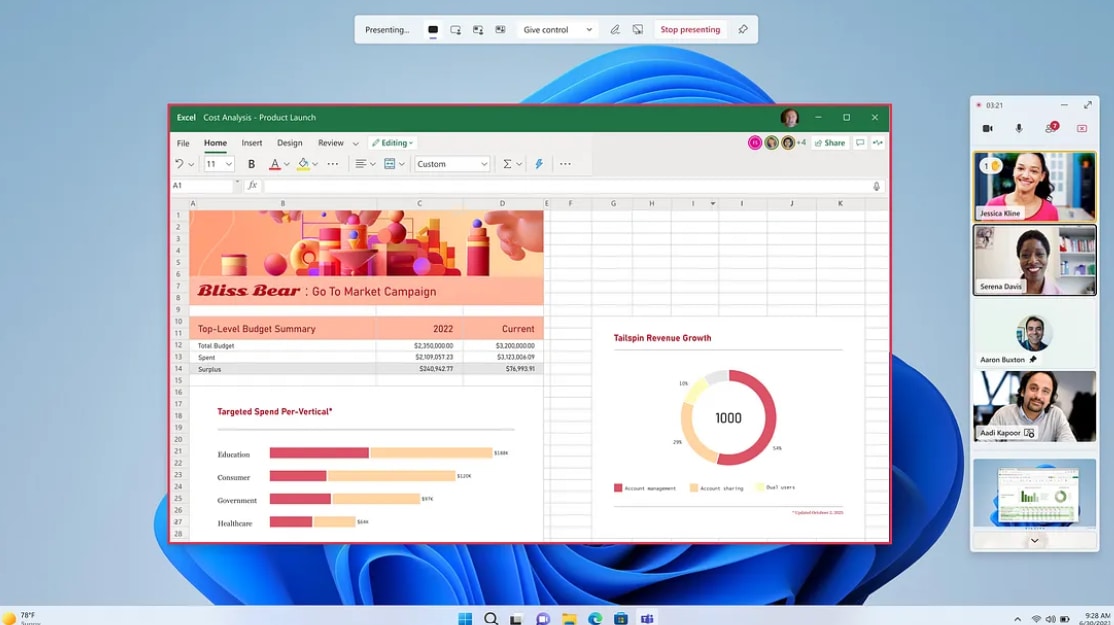

The immense promise of AI for now outweighs any of these concerns. Microsoft forecast cloud revenue growth to be 26% to 27%, with 1 percentage point being driven by AI services. That detail was just one example of more than 50 mentions of AI during the earnings call.

Nadella rightly smells blood in its quest to topple Google's longstanding dominance of search, and feels advancements in AI could also help it close the gap with Amazon's cloud business, AWS. It would be foolish to let either opportunity slip by in the name of cost-cutting.

“We'll manage the P&L carefully driving operating leverage in a disciplined way,” Nadella said to investors this week. “But not being shy of investing where we need to invest in order to grab the long-term opportunity.”

Microsoft stock is set to end this week up by around 6%, keeping the group comfortably over the $2 trillion market cap — a remarkable feat given Wednesday's shock announcement that the UK's competition authority would block its mega deal to acquire games-maker Activision.

Wall Street trusts that this will be Microsoft's year — and I can find few reasons to disagree. The company that brought desktop computing to the masses seems ready and able to do the same with AI.

(This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners. Dave Lee is Bloomberg Opinion's US technology columnist. Previously, he was a San Francisco-based correspondent at the Financial Times and BBC News.)

Catch all the Latest Tech News, Mobile News, Laptop News, Gaming news, Wearables News , How To News, also keep up with us on Whatsapp channel,Twitter, Facebook, Google News, and Instagram. For our latest videos, subscribe to our YouTube channel.