Apple keeps payments tech for itself but this could soon change in Europe

European Union antitrust chief Margrethe Vestager has begun scrutinizing Apple Pay, and antitrust regulators in the Netherlands and France are concerned, too.

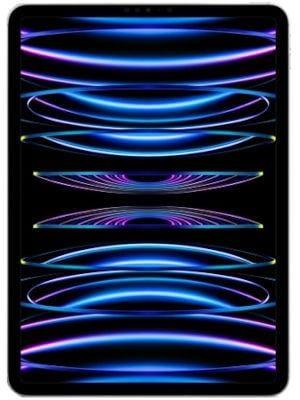

Apple Inc.'s digital wallet is expanding in Europe just as regulators crack down on the tech giant's move into financial services.

At issue is Apple's role as a platform for other services. Spotify Technology SA already complained to antitrust regulators that Apple favours its own music service. Now banks and other payments providers say the company gives its Apple Pay service an unfair advantage by limiting access to a key component inside iPhones.

"Access to technical interfaces is now a key competitive factor for payment systems," Kerstin Altendorf, a spokeswoman for the Association of German Banks, said. "The same conditions should apply to all market participants."

The arguments levelled at Apple come as lawmakers and regulators look to curb the power of Silicon Valley technology platforms, including Google and Facebook Inc.

European Union antitrust chief Margrethe Vestager has begun scrutinizing Apple Pay, and antitrust regulators in the Netherlands and France are concerned, too. In Germany, a law that kicks in Jan. 1 could force Apple to open up its payments technology more for competitors.

This is all bad timing for Apple, which is relying more on digital services like Apple Pay to generate growth. Its digital wallet is linked with 900 banks in Europe already and the company plans to work with another 1,500. How well that goes will partly depend on the fight for access to Apple Pay tech.

Vestager's officials have sought industry feedback on how iPhones may favor Apple Pay over other payment solutions. While that hasn't triggered a formal probe yet, Vestager said she's heard "many, many concerns" over the service and how that might hamper competition for easy payments.

Bad blood between Vestager and Apple won't help either. Chief Executive Officer Tim Cook called one of Vestager's decisions "political crap" when the EU ordered Apple to pay Ireland 13 billion euros in unpaid taxes.

And Vestager's concerns about Apple Pay are echoed by other antitrust regulators in the region. France's antitrust regulator has warned about new entrants to quickly gaining dominant positions, and the Dutch regulator in October launched a market study to analyze the impact of big tech firms on its payments market.

Germany is on the front lines of this battle. A law, kicking in Jan. 1, requires operators of digital money infrastructure to open up access to competitors for a reasonable fee. While Apple isn't mentioned in the law, the company may be most exposed because Apple Pay relies on the iPhone's near-field communications chip for slick in-store payments.

Wireless payments are powered by so-called NFC chips, that let thousands use their phones to pour through subway ticket gates in London and Tokyo. The component also handles the wireless signals that allow Apple Pay users to wave their phones at store terminals for instant charges to a credit or debit card. Banks want the same functionality for their own iPhone apps and complain that Apple won't give them access to the chip.

Germany could force Apple's hand. The new law requires "non-discriminatory access to the technical infrastructure" said Altendorf, the spokeswoman for the German bank association. That's a step in the right direction, she added.

Apple has already had to make changes to Apple Pay in response to an antitrust complaint in Europe. Swiss mobile payment app Twint contacted regulators because Apple's wallet app kept automatically launching when customers tried to use Twint's QR-based app at payment terminals. Apple last December agreed to implement a technical solution, deactivating NFC when the Twint app is open to stop Apple Pay interfering with its competitor's service.

Apple says it restricts access to the iPhone's NFC chip as part of a system that encrypts users' card information. Allowing competing mobile payments apps to access the NFC chip decoupled from Apple's added layer of security could increase the risk of fraud and other security breaches, it said.

Apple believes "deeply in competition," it said in a statement, and the company has tried to make the service "the kind of seamless and convenient payment and wallet system that our users want and expect."

Customers can also still use alternative mobile payment options on Apple devices where transactions are processed through black-and-white QR codes instead of NFC technology.

Security concerns may scupper these QR-based alternatives, which are used by Twint, Payconiq International SA and other Apple Pay rivals.

QR codes can be easily spoofed, according to James Moar, an analyst at Juniper Research. "I don't really see that as viable competition to Apple Pay in Europe at this point," he said.

Catch all the Latest Tech News, Mobile News, Laptop News, Gaming news, Wearables News , How To News, also keep up with us on Whatsapp channel,Twitter, Facebook, Google News, and Instagram. For our latest videos, subscribe to our YouTube channel.