Nokia starts a strategy shift as it lowers outlook for 2020

Nokia will now have “a more focused approach,” the company said and will target even more investment in the next generation of wireless technology.

Nokia Oyj shares fell as much as 18%, the most in a year, after its chief executive officer said he'll do “whatever it takes” to catch up with rival telecommunications equipment manufacturers.

Pekka Lundmark, who took the top job on August1, will abandon predecessor Rajeev Suri's strategy, dubbed “end-to-end”, the Finnish company said in a statement on Thursday. This aimed to provide customers with complete network systems, from physical equipment such as antennas and optical cables to software and other services.

Nokia will now have “a more focused approach,” the company said, and will target even more investment in the next generation of wireless technology. It will look to break down how it sells to clients and target higher-value sectors.

The shares traded at 2.85 euros at 11:18 a.m. in Helsinki after the company reported sales that missed analyst estimates and lowered its outlook for 2020.

“We have lost share at one large North American customer, see some margin pressure in that market, and believe we need to further increase R&D investments to ensure leadership in 5G,” Lundmark said. “In fact, we have decided that we will invest whatever it takes to win in 5G.”

New Opportunities

Nokia competitor Samsung won a $6.6 billion deal to provide 5G wireless solutions to Verizon Communications Inc. This represented “a significant competitive loss for Nokia,” given the company's relationship with Verizon, analyst Simon Leopold said last month.

The Espoo, Finland-based company is seeking to catch up with rivals Ericsson AB and Huawei Technologies Co. after early stumbles in the market for 5G and trouble integrating its giant Alcatel-Lucent purchase from 2016. Nokia reported sales in the third quarter of 5.29 billion euros ($6.21 billion), missing analyst estimates for 5.42 billion euros.

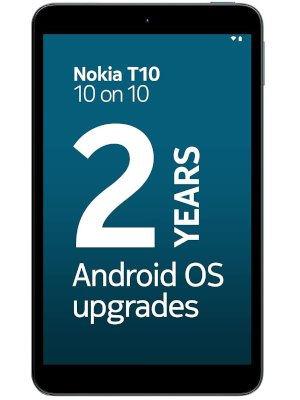

Also Read: Nokia 10 rumours surface as leaked internal document reveals HMD Global's future plans

“Nokia appears finally to recognize its problems openly and is starting what we think are the right measures to achieve a long-term turnaround in its direction,” Inderes analyst Mikael Rautanen said in a note. “The negative is that it's headed for sizeable structural changes, which will take time and money. Expectations over a turnaround in Nokia's earnings improvement have to be moved further into the future.”

Lundmark said in a call with reporters the company is well placed to take advantage of bans on some vendors. A growing number of governments are placing restrictions or outright exclusions of gear made by Huawei.

“Some of the geopolitical trends are opening up new opportunities,” Lundmark said on a call with reporters. “We understand that the safety and security of the network and the trustworthiness of the vendor is extremely important, it's going to be increasingly important in the future.”

Nokia paused its dividend a year ago to funnel more cash to research and development, and said payouts are likely to resume once its net cash position improves to about 2 billion euros. Nokia ended the last quarter with a net cash balance of 1.9 billion euros, it said.

Lundmark declined to comment on the prospects for the dividend to be reinstated, saying in an interview that the board will assess the cash position at the end of the year.

Also Read: Nokia escalates patent wars by taking on German Lenovo sales

“We will know more about the 5G situation and how much exactly that expected investment will have to be and all this will be a factored into that discussion and proposal,” he said. When asked about borrowing to pay for investment, he said, “we have no problem borrowing money from the market.”

Nokia also downgraded its prospects, saying it expects to underperform in a declining market. It had previously expected a “flattish” market in 2020.

Next year, it expects an adjusted operating margin in the range of 7% to 10%, missing the average analyst estimate of 10.6%. For 2020, it now sees adjusted earnings per share of 20 euro cents to 26 euro cents, compared with 20 cents to 30 cents previously, and an adjusted operating margin of 8% to 10%, compared with an earlier 8% to 11%.

Nokia will share further information about strategy changes on December 16 and at a Capital Markets Day on March 18.

“I have no doubt that the potential of Nokia is substantial, even if delivering on that promise will take time,” Lundmark said. “We expect to stabilize our financial performance in 2021 and deliver progressive improvement towards our long-term goal after that.”

Catch all the Latest Tech News, Mobile News, Laptop News, Gaming news, Wearables News , How To News, also keep up with us on Whatsapp channel,Twitter, Facebook, Google News, and Instagram. For our latest videos, subscribe to our YouTube channel.