Nintendo Bulls Betting Switch Can Provide Gaming’s iPhone Moment

While Nintendo has frequently made reference to extending the Switch’s lifetime compared to previous consoles, it has not said it is pursuing an Apple-like business model.

With Nintendo Co stock approaching its all-time high, there are some who see the creator of the Super Mario franchise as approaching a pivotal moment that could turn its flagship Switch into a perpetual gaming platform and break free of the industry's traditional boom-bust cycle.

While many longtime Nintendo watchers wonder if the high watermark is near, others say strap in: like Tesla Inc., they say, Nintendo's stock is poised to head to the moon, with some expecting the stock to double, triple or even rise five times. Shares are up 30% this year, with Switch sales up 95% in the first half.

Some Nintendo bulls believe the company can transform into one that's able to roll out incremental new platforms while retaining its user base. Hit products such as the Wii were often followed by much less successful ones, such as the disastrous Wii U. With each new console, the Kyoto-based gaming company rolled the dice on making the new machine a success, and while it got things right this generation with the Switch, a successor console would have no guarantee of similar sales.

“With every console generation, the install base resets to zero and their earnings power essentially resets to zero,” said Toan Tran of investment manager 10 West Advisors. He says Nintendo can break free by releasing a new and more powerful iteration of the Switch every few years. “They can continuously have an install base of say 100 million consoles out there, that just moves along over time.”

ALSO READ: Nintendo Switch may get an upgrade with 4K support in 2021

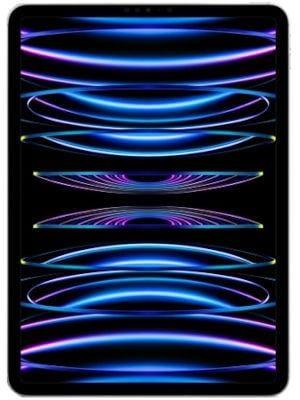

That kind of perpetual platform model already exists: Apple Inc.'s iPhone. Like the smartphone, new versions of the Switch could be backwards-compatible with all games released so far while becoming more powerful and feature-rich. That would keep customers locked into Nintendo's entertainment ecosystem — on top of its exclusive first-party titles — while making profits and sales more predictable.

Multibagger Potential

While Nintendo has frequently made reference to extending the Switch's lifetime compared to previous consoles, it has not said it is pursuing an Apple-like business model. And whether it could or would even want to pursue this model remains up for debate. One factor for skeptics is that sticking to the Switch could limit the bold hardware innovation Nintendo has relentlessly pursued in its devices — from the Wii's motion controller to glasses-free 3D technology of the 3DS to the portable console innovation of the Switch.

Buoyed by growing demand for its consoles that Nintendo still can't match, shares recently broke through the psychologically important 50,000 yen barrier with the all-time high of 73,200 yen insight. Nintendo forecasts revenue will decline slightly this year to 1.2 trillion yen, despite a pandemic-fueled record first quarter. Conservative to the point of parody, the outlook is all-but-certain to be upgraded. Analysts predict, on average, that Nintendo will report sales of 1.42 trillion yen for the fiscal year to March.

Retail investors in the U.S., whose influence on the market has been surging, have also started to take notice of the stock, with Nintendo one of the most-held Japanese stocks by users of the Robinhood app. Shares rose as much as 1.4% in Tokyo trading on Tuesday.

ALSO READ: Nintendo boosts Switch production by another 20%

“Its valuation continues to be inexplicably low,” said Aaron Edelheit, chief executive officer of Mindset Capital. “The company is innovating at a level that no one is giving them credit for.”

Nintendo is in the same position facing Microsoft Corp. in 2013, according to Edelheit: unloved by investors, misunderstood and facing a crossroads for its business model. Eventually, Nintendo will turn into a “multibagger” with the potential for shares to rise fivefold, he said.

Nintendo trades at around 20 times estimated 12-month earnings compared with an average of around 38 times for the so-called FAANG group of U.S. tech giants.

Yet many long-time Nintendo watchers have heard this before and remain skeptical. Investors are still scarred by the stock's dramatic plunge at the peak of the Wii's success, and the company's failure to capitalize on what was at one point one of the world's most recognizable brands when it bungled the rollout of the Wii U.

“The peak is higher than what I was forecasting before, because of Covid — but the peak is still next year,” said Atul Goyal, senior analyst at Jefferies Group, who predicts that earnings will peak in the next fiscal year, which ends March 2022. “The bulls themselves don't have proper growth beyond next year.”

Goyal upgraded the stock to a buy-in September with a price target of 69,500 yen and is positive on the company's near-term prospects, but said that “based on what we know today, the upside is very limited beyond 70,000 yen.” Goyal wrote in September that the pandemic had given Nintendo “one more year to fix its long-term strategy before the market starts worrying about Switch cycle earnings peak.”

At a recent briefing, management dropped hints of using its Nintendo Account to lock users in, something it couldn't do with Super Nintendo or Wii users, and gave a sly reference to its next gaming system launching in “20XX” (not, as many noted, “202X”).

“We can't simply follow what other companies are doing or chase the latest technology trends,” Nintendo said in the presentation — perhaps a nudge at critics who for years have said it should abandon developing its own hardware and shift to mobile games.

The briefing also frustrated many investors who have called on Nintendo to give more clarity on its future plans. It was also notable for what it didn't announce — no change to its earnings forecasts, and no mention of a rumored more powerful iteration of the Switch. Bloomberg News has reported that Nintendo plans to debut the new model next year.

“The million dollar question here is, is Nintendo the hits-driven cyclical that defined its history pre-2017?” says Ryan O'Connor, the portfolio manager of Kansas City-based investment firm Crossroads Capital. He says no, and is convinced Nintendo has dropped enough hints to justify his long-held belief that the Switch will be a perpetual platform and not the latest cycle.

Roblox, Fortnite

Matthew Ball, a former head of strategy at Amazon Studios and the managing partner at Epyllion Industries, warned in an essay that Nintendo risks getting left behind as users' habits shift in the age of online gaming.

“Nintendo's games are more popular than they've ever been and they're also as creatively inspired as ever. There is no foreseeable future without millions of die-hard Nintendo fans,” he told Bloomberg News. “But in the first ten days of the month, more time will be spent playing Roblox or Minecraft or Fortnite or Grand Theft Auto than the lifetime playtime of the Legend of Zelda: Breath of the Wild.”

Bulls and bears alike can point to evidence backing up their case. Nintendo's paid online accounts are booming, with more than 26 million members, up 73% since January. Yet its mobile efforts continue to languish, with the gamemaker seemingly content to retreat from the sector while concentrating on the Switch.

But perhaps the factor that most limits the upside is the company's management itself. Nintendo has long been conservative in its approach to investors, and has become increasingly reluctant to share even its pipeline of forthcoming games, much less grand ideas that could inform investors of its long-term prospects. That reluctance is seen in a longtime refusal to countenance a stock split — a method Apple and Tesla have both employed this year.

A split could be transformational for potential Japanese retail traders — at 56,920 yen a share with a round lot of 100 shares, an investor needs a minimum of almost 6 million yen, more than the national average salary. Pleas for a split have met with deaf ears, even though it would likely also smooth Nintendo's entry into the benchmark Nikkei 225 index.

“I think Western investors get frustrated with the company's anti-promotional style in a time when companies like Tesla are dominating the market with over-the-top promotional styles,” Edelheit said.

But management's reluctance to engage with the market doesn't put off the most bullish, who say the market will get there in time itself.

“I don't think there's any reasonable future outcome that's not a multiple of the current price — even if management stays impossibly insular and trollish when it comes to investors,” O'Connor said. He started adding to his Nintendo position in March when he realized the effect the pandemic would have.

“Results over the next few years will force the market to recognize Nintendo's true value.”

Catch all the Latest Tech News, Mobile News, Laptop News, Gaming news, Wearables News , How To News, also keep up with us on Whatsapp channel,Twitter, Facebook, Google News, and Instagram. For our latest videos, subscribe to our YouTube channel.