Big Tech earnings approach under antitrust cloud

Big Tech for years has been criticized for choking competition and stifling smaller competitors, and investors are looking for signs that they are extending their lead during the pandemic.

Apple, Alphabet, Amazon and Facebook, together accounting for about a fifth of the S&P 500's total value, report their quarterly results on Thursday, with their stocks trading near record highs, even as they face increasing antitrust scrutiny.

Amazon and Apple have surged 74% and 57%, respectively, this year, far outperforming the S&P 500's 5% gain as the coronavirus pandemic accelerates trends toward online shopping, video streaming and other technologies helping Wall Street's largest companies take market share from smaller rivals.

Big Tech for years has been criticized for choking competition and stifling smaller competitors, and investors are looking for signs that they are extending their lead during the pandemic. However, antitrust storm clouds in recent months have increased.

A scathing report by a House of Representatives panel this month detailing abuses of market power by large tech companies suggests a tough road ahead should Democratic presidential candidate Joe Biden, who is leading in polls, win the Nov. 3 election.

"There seems to be a lot of angst and desire to not only fine these companies, but potentially change the way they do their business. In the past, there was a lot of lip service, but now you are starting to see some pretty active postures," said Dan Morgan, a portfolio manager at Synovus Trust.

Morgan said he expects to see companies set money aside to pay for potential future fines.

Apple, Google-parent Alphabet, Amazon and Facebook have a combined stock market value of $5.5 trillion, compared to the S&P 500's $29 trillion market capitalization.

Their reports come amid turbulence on Wall Street, with the S&P 500 on Monday posting its biggest daily decline in four weeks, as soaring coronavirus cases and uncertainty about a fiscal relief bill in Washington dim the outlook for an economic recovery.

Microsoft, which posts its results late on Tuesday, has elevated its stock market value by a third in 2020 to $1.6 trillion. Investors expect the software maker to report an 8% rise in quarterly revenue and a 10% jump in net income, with Cowen analyst Derrick Wood saying in a recent client note that Windows sales could get a lift from additional laptop demand as people keep working from home.

S&P 500 technology sector earnings per share are seen rising 0.3% in the third quarter, according to I/B/E/S data from Refinitiv.

By comparison, analysts expect S&P 500 companies to see an aggregate decline of 16.7% in their third-quarter earnings as the U.S. economy remains crippled by the pandemic.

Amazon's September-quarter report will likely be a "calm before the storm" as the online retailer builds more fulfillment centers in anticipation of a busy holiday shopping season, Bernstein analyst Mark Shmulik wrote in a client note on Monday.

"With a holiday crunch expected, the scale and pace at which (Amazon) is bringing incremental capacity online is encouraging," Shmulik wrote.

Twitter also reports its results on Thursday, with analysts on average expecting a 9% revenue decline as advertisers hurt by the pandemic spend less.

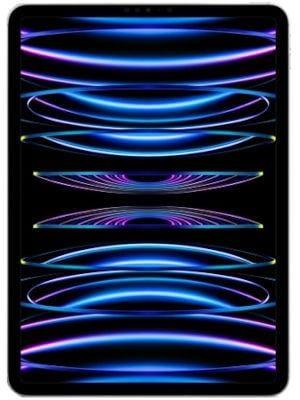

Analysts on average expect Apple's report after the bell on Thursday to reflect a 0.5% drop in revenue to $63.7 billion and net income down 11.2% to $12.1 billion. However, Apple investors are mostly focused on the outlook for sales of the newest iPhone and growth in recurring revenue from apps, games and video and music streaming. (Reporting by Noel Randewich; Editing by Christopher Cushing)

Catch all the Latest Tech News, Mobile News, Laptop News, Gaming news, Wearables News , How To News, also keep up with us on Whatsapp channel,Twitter, Facebook, Google News, and Instagram. For our latest videos, subscribe to our YouTube channel.