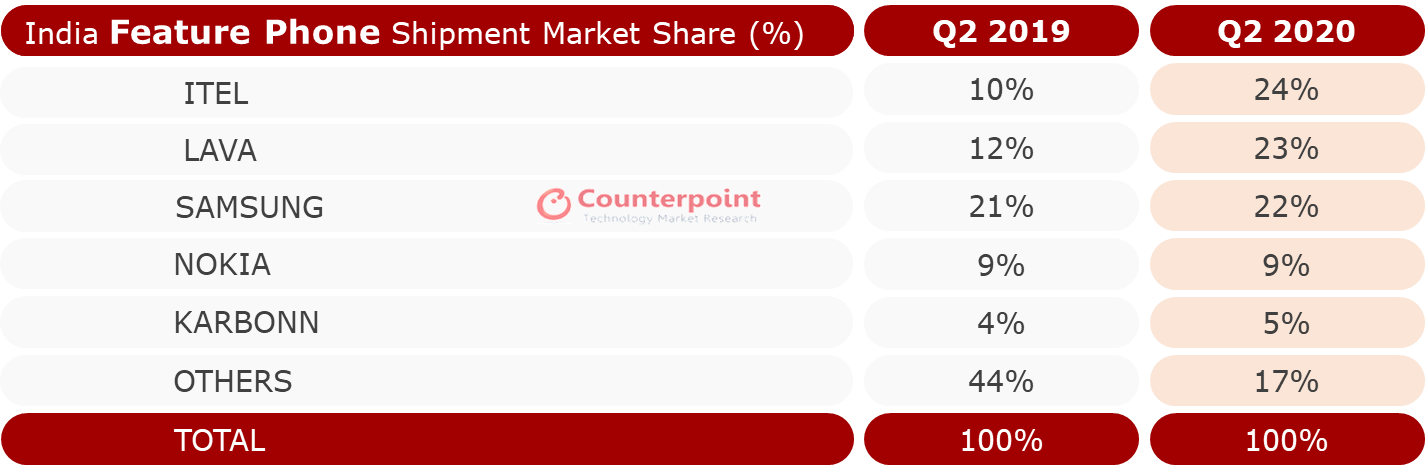

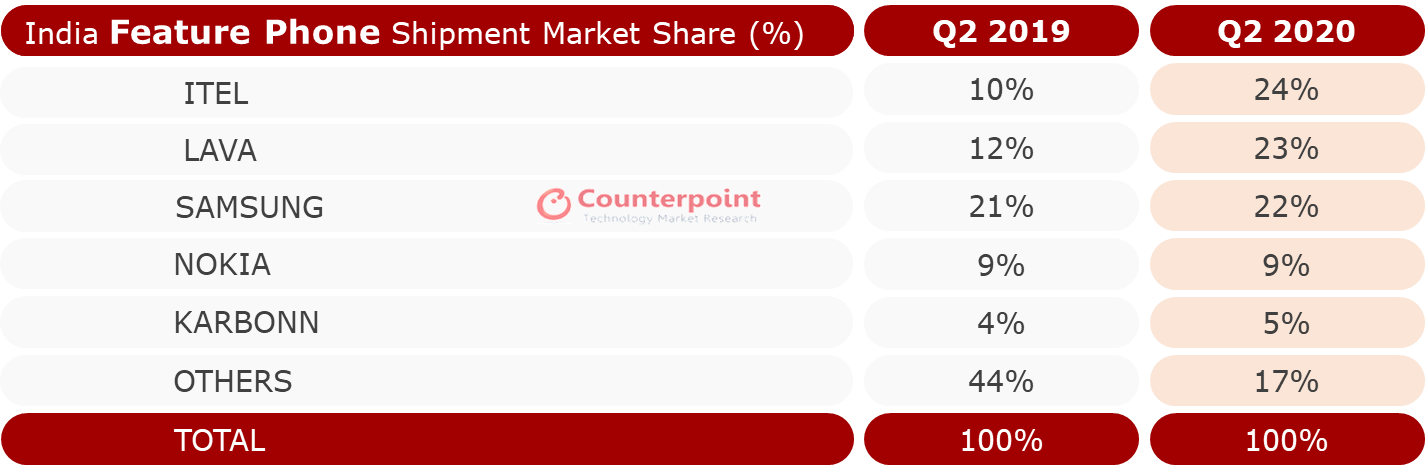

Chinese smartphones' market share in India drop 9% amid anti-China sentiments, Covid-19 lockdown

From a 81% in Q1 2020, the market share of Chinese smartphone brands in India fell to 72% in Q2 2020 according to Counterpoint’s Market Monitor research.

Amid the nation-wide lockdown, India's smartphone shipments fell by 51% year-on-year (YoY) to a little over 18 million units in Q2 2020. According to the research report by Counterpoint's Market Monitor service, the nationwide lockdown lead to zero shipments for smartphones in April this year.

However, now that the lockdown is gradually being eased, June registered a mild decline of 0.3% YoY with pent-up demand and push from brands making things marginally better for the smartphone market.

Most importantly though, driven by a growing anti-China sentiment and the lockdown together, the contribution of Chinese brands fell to 72% in Q2 2020 as compared to 81% in Q1 this year.

_1595587685685.png)

_1595587685685.png)

“The contribution of Chinese brands fell to 72% in Q2 2020 from 81% in Q1 2020. This was mainly due to the mixture of stuttering supply for some major Chinese brands such as Oppo, Vivo and Realme, and growing anti-China sentiment that was compounded by stringent actions taken by the government to ban more than 50 apps of Chinese origin and delay the import of goods from China amid extra scrutiny. This all resulted from the India-China border dispute during June,” Shilpi Jain, Research Analyst at Counterpoint Research said.

Jain added that local manufacturing, R&D operations, attractive value-for-money offerings and strong channel entrenchment of Chinese brands left very few options for consumers to choose from and users still had to buy Chinese smartphones.

Nonetheless, this development gave a window of opportunity for brands like Samsung and local Indian brands such as Micromax and Lava, to recapture market share.

“Further, Jio-Google's partnership to bring a highly affordable 4G Android smartphones could also gain ground, banking on the growing #VocalforLocal sentiment,” Jain added.

Despite supply constraints and the rising negative consumer sentiment towards China, Xiaomi continued to lead the Indian smartphone market in Q2 2020 with models like Redmi 8A dual, Redmi Note 8 Pro and Redmi Note 8 continued to attract consumers' interest thanks to competitive pricing, strong value propositions and good channel reach.

With the launch of the Xiaomi Mi10 5G, the brand entered the ₹45,000 and up category and this along with its ever-expanding IoT ecosystem and new earbuds, Xiaomi made sure it was ahead of the competition.

Catch all the Latest Tech News, Mobile News, Laptop News, Gaming news, Wearables News , How To News, also keep up with us on Whatsapp channel,Twitter, Facebook, Google News, and Instagram. For our latest videos, subscribe to our YouTube channel.