What's behind the video-game layoffs? Players sticking with old favorites

With video-game players increasingly sticking with the titles they’ve been hooked on for years, leaders in the $184 billion industry are cutting thousands of staffers and canceling riskier projects.

View all Images

View all ImagesWith video-game players increasingly sticking with the titles they've been hooked on for years, leaders in the $184 billion industry are cutting thousands of staffers and canceling riskier projects.

Over 6,400 video-game workers have lost their jobs over the past two months at companies such as Microsoft Corp., Embracer Group AB and Tencent Holdings Ltd.'s Riot Games.

Riot Chief Executive Officer Dylan Jadeja cut 530 positions in January, saying the company needed to focus on the “core of our business,” including existing hits like 2009's League of Legends. Management has to “make hard choices when our bets aren't performing as well as we hoped,” he said in a note to staff.

Embracer canceled a game in the Deus Ex series after two years of work and laid off developers last month. Microsoft let go 1,900 staffers in its games division in January. Among the casualties, the survival game Odyssey, which got axed after six years of development at its recently acquired Activision Blizzard unit.

“Starting something completely new is among the hardest things to do in gaming,” said Andrew Reynolds, a spokesman for Blizzard.

The growing caution stems in part from the high price of making blockbuster games that meet modern players' expectations for scale and graphical fidelity, analysts said. Development costs have skyrocketed, making it tougher to dethrone popular titles. Executives' optimism that the pandemic-induced boom in playing would persist also led to bloat and inefficiencies.

“Premium game development has been risky forever, but the biggest factor is that 3-million-unit sellers don't make money anymore,” said Michael Pachter, an analyst at Wedbush Securities Inc.

In the past, a blockbuster game would take 100 people and about $30 million to develop, while today it's more like 400 people and $200 million, he said. Game development may stretch as long as eight years.

Consumers are drawn to, and companies are focusing on, multiplayer games that can occupy people around the world for hours. Titles like Epic Games Inc.'s Fortnite are updated frequently with fresh characters and stories that encourage players to make regular in-game purchases. In one recent survey of 537 studios, Griffin Gaming Partners determined that 95% were making such titles. Walt Disney Co. last week said it would invest $1.5 billion in Epic to create a Fortnite universe tied to Disney characters.

The audience for so-called “live service” games has tripled, while that for single-player ones hasn't grown, said Joost van Dreunen, who lectures about the industry at New York University.

When a blockbuster single-player game comes out, the action for a title like Fortnite might dip a bit. Then, after a week or two, the player counts generally return to normal, he said.

“People like the comfort of their game worlds,” van Dreunen said.

While 2023 was one of gaming's best years ever — with critically acclaimed releases from Sony Group, Nintendo Co. and Activision — the quality threshold for games that pull players away from trusted, older titles is increasingly high. The most played personal computer games on market researcher NewZoo's top 20 list includes Minecraft, released in 2009, and 2020's Valorant.

Players return to these games because their friends are also playing and they've often accumulated years' worth of in-game items purchased with real money, NewZoo analyst Tom Wijman said in an interview. The typically free-to-play titles allow developers to fix problems and study what motivates gamers to keep coming back.

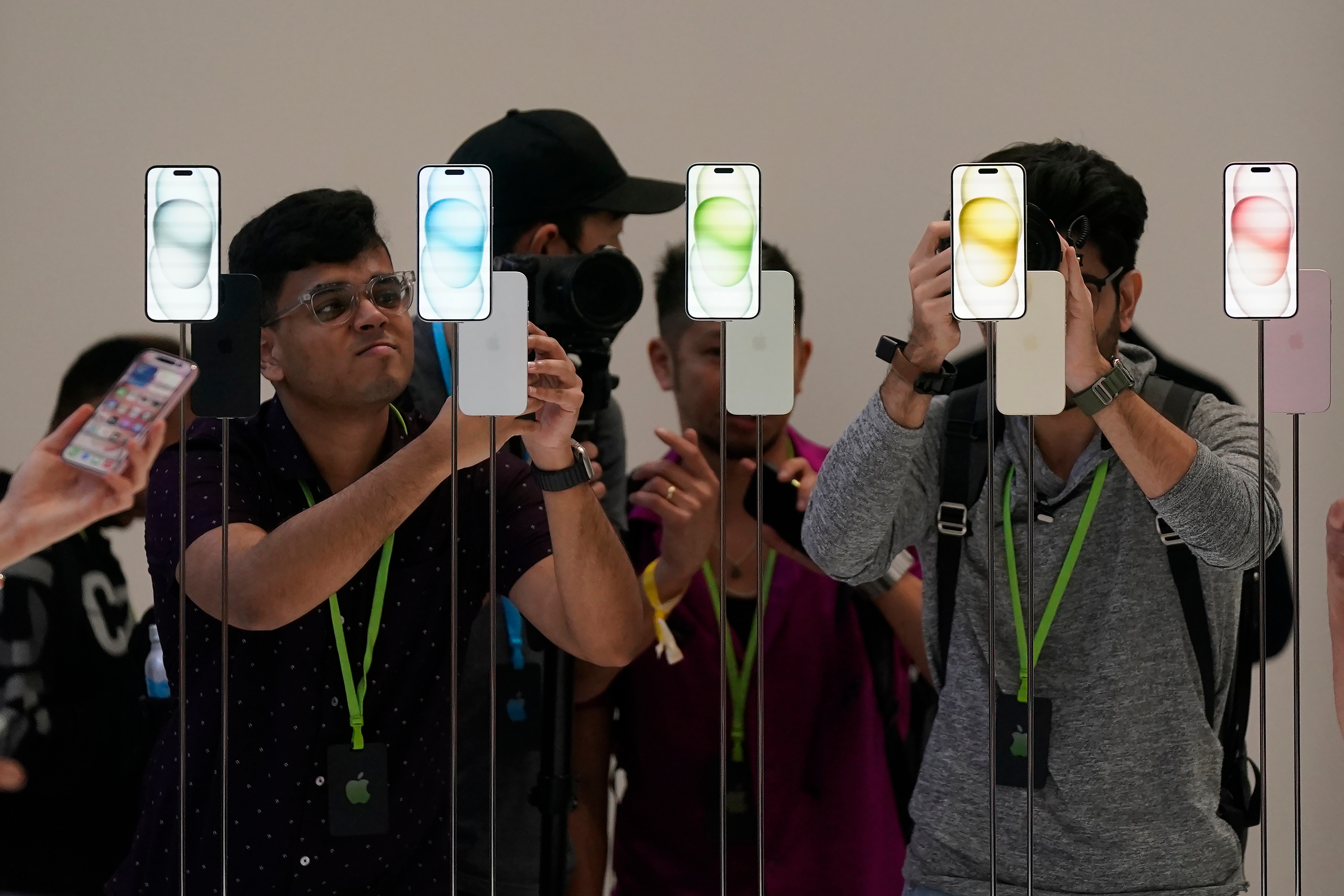

A new generation of consoles could change that calculus — inviting consumers who are more open to technological changes and new titles.

Rumors of a new Nintendo Switch device abound as the current Xbox and the PlayStation iterations celebrate their fourth birthdays this year. On Thursday, Microsoft announced it would begin offering older games that were previously exclusive to Xbox on competing hardware devices to boost sales.

“At the end of the cycle, most of the consumers buying consoles and software now are very conservative,” said NYU's van Dreunen. When new hardware lands, he added, gamers may be more excited to open their wallets and play something new.

Catch all the Latest Tech News, Mobile News, Laptop News, Gaming news, Wearables News , How To News, also keep up with us on Whatsapp channel,Twitter, Facebook, Google News, and Instagram. For our latest videos, subscribe to our YouTube channel.