Do you save debit card, credit card ATM PIN, Aadhaar card, PAN on phone? STOP now

A huge number of Indians store their bank debit card, credit card ATM PIN, Aadhaar card, PAN number, other passwords on their phone or email thereby opening themselves to a big money loss.

When it comes to money, some people just ask for trouble. Now, a bank account is a very serious thing, but many Indians have been found to store their debit card and credit card ATM PIN, Aadhaar card, PAN number, other passwords on phone or email. Securing personal and private information is an important, yet often overlooked task that many users do not take seriously – both in India and abroad. Perhaps it is no surprise, then, that the incidents of cybercrimes are going up, even with many people staying indoors during the pandemic. One of the most sought after avenues for hackers to gain user information is through phishing and other misleading tricks designed to glean information from an unsuspecting user. A recent survey by social media platform LocalCircles has revealed that many users still do not follow security practices suggested by experts, while using insecure methods to store their bank debit card and debit card ATM PIN, Aadhaar card, PAN number and more.

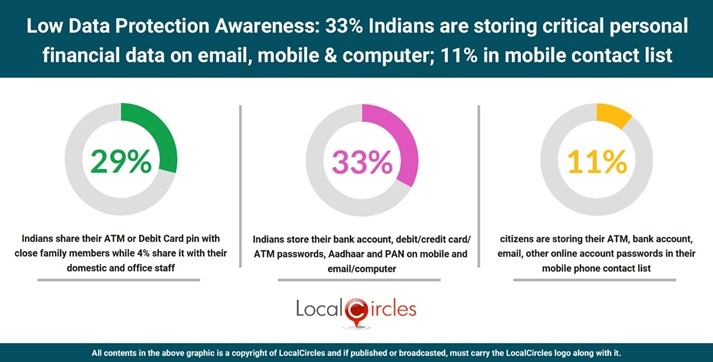

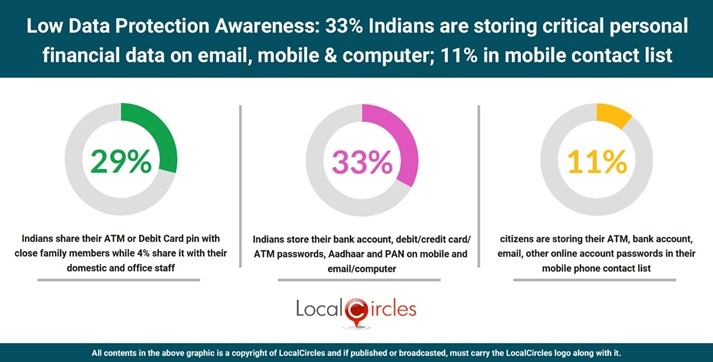

As part of the survey, over 24,000 responses were collected from 393 districts in the country – 63 percent of these were men and 27 percent were women. Twenty-nine percent of participants in the survey (out of 8,158 responses to this question) said that they gave their debit card and credit card ATM PIN to ‘one or more' close family members. Four percent stated they gave it to domestic staff. However, importantly, 65 percent said they do not share the information with anyone else.

Also read: Looking for a smartphone? Check Mobile Finder here.

The survey also revealed worrying responses related to storing of personal information. One question was related to how users handled their bank account details, debit card or credit card (CVV) number or their ATM PIN, Aadhaar card or PAN number. Twenty-one percent of 8,260 responses claimed that they had their information memorised (which is generally bad because it could imply reusing of passwords) while 39 percent of respondents stated that they stored their passwords in written form on paper.

Meanwhile, 33 percent of respondents stated that they stored this data in digital form on their phones, email and computer. The survey also revealed that around 11 percent of respondents were storing important information in their phone's contact list, which can prove to be disastrous for privacy as many apps request access to a users contact list and a service with poor security practices can leak all your personal information to malicious users.

The survey notes that the Reserve Bank of India and other banks should make efforts to improve digital literacy among users, to show people how to protect their personal information safely online. Users should also make sure to use a secure secrets storage service like Bitwarden Password Manager to store their bank account details, debit card or credit card ATM PIN, Aadhaar card or PAN number and other information safely without exposing it to other users.

Catch all the Latest Tech News, Mobile News, Laptop News, Gaming news, Wearables News , How To News, also keep up with us on Whatsapp channel,Twitter, Facebook, Google News, and Instagram. For our latest videos, subscribe to our YouTube channel.