Here’s why building a smartphone without US tech is impossible

Breaking down challenges and opportunities for a company to build a smartphone without using technology from the US. Here’s how your smartphone may look like without the American technology.

Huawei is caught in the crossfire of the US-China trade war. With the US firms barred from trading with Huawei, the Chinese conglomerate faces an existential crisis: building a handset from scratch.

Huawei is the second biggest smartphone brand in the world that shipped more than 200 million handsets last year; but even for a company with such stature, making a phone from the ground up -- especially without sourcing components from the US -- is increasingly proving to be a herculean task.

Actually, let's put Huawei aside, it is next to impossible for any smartphone vendor to operate without resorting to American technologies - well, such is the complex nature of a phone. From tiny processors to the operating system that they run, US technology companies play an existential role in a myriad of aspects that go into the smartphones.

The state of things

In the last decade, smartphone manufacturing plants have mushroomed in China, Taiwan and other Asian markets. And even as they are bandying out millions of handsets each day, it is the US companies that own intellectual property rights and design expertise on those devices, explained Faisal Kawoosa, founder and analyst at research firm TechArc.

"Our dependency on US technology firms is very high. Unlike the West, Asian and Indian companies haven't been able to venture much into this and related segments. Essentially, Asian firms may have excelled in manufacturing and hardware, but not so much when it comes to actually designing hardware," he added.

And it's rather shocking. "For instance, India has one of the best space researches and an excellent record of building satellites, but the country doesn't have the expertise to build processors. Even if these are locally developed, the industry standards set by the likes of Intel and others make them look redundant. From an achievement point of view, it makes sense. But you can't expect a commercial implementation of these locally produced chips in the future," he added.

ALSO READ: Billionaire Huawei founder defiant in face of existential threat

Another senior analyst, who did not wish to be quoted by their name to continue healthy a relationship with various stakeholders, said, "the US firms hold all the crucial IPs. It is very difficult to develop a smartphone without their IPs. From chip-level design to 4G and 5G standards, these companies have a monopoly. For any smartphone brand to bypass this is not practical at all."

If the Trump administration in the US and China don't resolve their issue in the coming months, Huawei will have no choice but to explore alternatives to all sorts of things to continue its smartphone operation. But what if, say hypothetically, other smartphone brands face a similar issue in the future? Say brand X, chooses to go ahead with developing a phone without the technology sourced from the US, how can they go about it? Let's ponder.

A small disclosure: We've excluded components such as the battery and accessories that are relatively readily available at disposal today and are easier to manufacture outside the US -- without violating any crucial IPs.

Display

Top smartphone display makers aren't from the US. So this should not be difficult for our supposed brand X, as it can either side with LG, Samsung, or Toshiba for the screen. It is worth noting that even Apple uses Samsung's display on its iPhones. In China, there is also a display firm called BOE Technology Group that can offer a helping hand. This company is said to be working on advanced OLED panels that are increasingly showing up on current-generation high-end smartphones.

Simply put, even if a US ban were in place, a phone company can easily source smartphone screens. Of course, there will be no Gorilla Glass technology to further shield those displays, but the brand X can consider Japanese AGC Inc, erstwhile known as Asahi Glass Co. Ltd., which offers similar Dragontrail display glasses.

Camera

Just like smartphone screens, none of the US companies are considered big in the camera sensor business. Some of the top smartphone camera sensor makers include Sony, Samsung, and Toshiba. Already, Sony's IMX586 sensor has become a popular choice for smartphones' 48-megapixel sensor. Samsung is already upping the game with an improved 48-megapixel sensor, and a new 64-megapixel sensor for phones.

ALSO READ: List of tech companies that have cut ties with Huawei

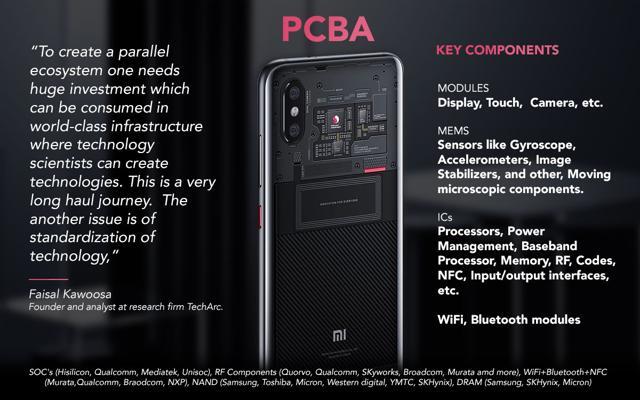

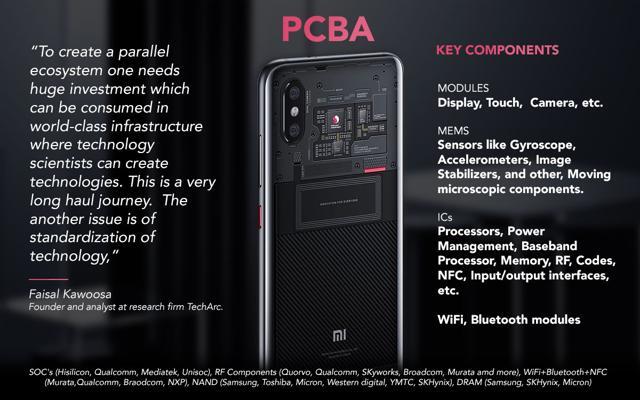

PCBA

The engine of a smartphone is PCBA. The module houses multiple components including SoCs, RF components, Wi-Fi, Bluetooth, NAND and DRAM among others. Each component powers a different aspect of a phone.

Some of the top SoCs companies are Hisilicon, Qualcomm, Mediatek and Unisoc. While Huawei owns HiSilicon, MediaTek is a Taiwanese company. Unisoc is based in China. The US-based Qualcomm, however, is considered superior among the mobile chip players.

The catch is that their chip design is primarily sourced from ARM Holdings, a UK-based firm but with chip designs containing "US origin technology". These SoCs operators secure a license from ARM for their own chips. Without ARM, as seen in the case of Huawei, it becomes very difficult for a smartphone brand to build a chip that's been designed from scratch.

Counterpoint in its recent report said, "All of Huawei's smartphones run on ARM architecture. The current chipsets already designed may not be affected, but the newer chipsets for late Q4 2019 will not be able to use ARM's license. This will affect even smartphone sales in China."

"Qorvo, Skyworks, and Broadcom RF components will be hard to replace for Huawei's high-end LTE smartphones," it added.

ALSO READ: Huawei customers worry: Will my phone work without Google?

As far as connectivity goes, 3GPP makes basic standards for 3G, 4G, and 5G standards. Major players like Qualcomm, Nokia, Ericsson, Huawei, ZTE and many other players own IPs for this. In a shared arrangement, a brand may have a few workarounds to secure radio license but may end up missing out on some.

In the case of Huawei, SD Association temporarily banned the company, resulting which future Huawei phones may miss out on supporting or using microSD cards. Even Wi-Fi Alliance "temporarily restricted" Huawei.

Imagine a phone without memory and Wi-Fi support.

"Semiconductor design and development is a very capital and knowledge intensive business. Successful silicon companies spend billions of dollars on R&D annually, which is anywhere between 10-20% of their revenues. This should also be backed with support from best technology institutes. So essentially, all such technologies including their IPs are owned, co-developed or controlled by one or the other US company," Kawoosa explained.

Operating system

The software situation is a bit more complicated. Also, note that the operating system and chipset are co-related.

"The OEMs get drivers from the chipset maker which in turns sources design from the likes of ARM. To write the operating system you have to use their architecture and write drivers that can talk to the hardware for proper implementation," said Harsha Halvi, co-founder of TGB Labs working in area of mobile and SAAS apps.

"If you want to build an operating system, you have to bypass all these drivers and write them on own. For instance, Huawei uses ARM-based in-house Kirin chipsets. Huawei is writing its own drivers and they have greater control over the system. So they have to write drivers first and on top that they have to write kernels. After that, they can build their own operating system. But it is very difficult for a new or existing company with no such R&D backing to do so," he added.

Since the extinction of OSes such as Windows Mobile and BlackBerry, there hasn't been any competition for Google's Android. Samsung does offer Tizen OS, but the software failed to take off on phones and is currently limited to wearables and TVs. Apple and its closed software ecosystem are also out of the question.

Without Android or Google's open-source AOSP, the mobile OS will not be able to replicate the same experience that you get on your phone. For starters, you will lose access to all key Google applications ranging from Gmail to Search. Let's not forget other third-party applications such as Facebook, Twitter, WhatsApp, Skype, Amazon, Netflix, and others. Users will be forced to sideload applications instead of regular apps tore.

In China, where Android is already blocked, you have some alternatives to all of these applications but these alternative apps are unlikely to gain traction in other markets.

One can either create a new app store with a customised version of these popular applications or simply rely on mobile browser versions of the same. You, user, already know the stark difference between using an app and opening a browser version of the same. From a user experience point of view, a custom OS without top apps will be bland at best.

Bottomline

The challenges that a hypothetical Brand X is facing today could be a reality tomorrow, for everyone. The case of Huawei clearly stresses the need for an open-source framework which gives an equal opportunity to all smartphone companies regardless the country of their origin. It's also a good wake up call for these firms to invest more in IPs and be more self-sufficient in the future.

Catch all the Latest Tech News, Mobile News, Laptop News, Gaming news, Wearables News , How To News, also keep up with us on Whatsapp channel,Twitter, Facebook, Google News, and Instagram. For our latest videos, subscribe to our YouTube channel.