No vulnerability of UPI or BHIM, assures NPCI

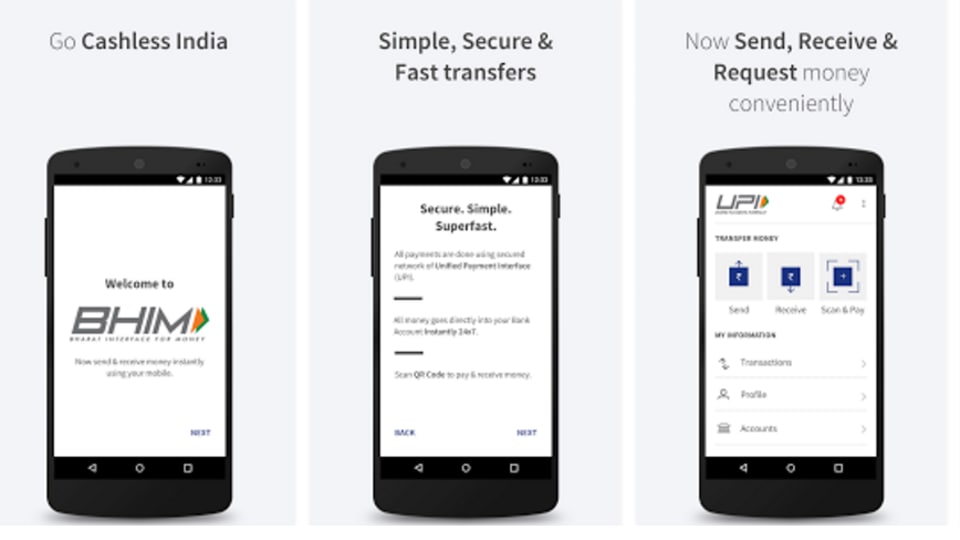

The National Payments Corporation of India (NPCI) on Monday assured that there is “no vulnerability of loopholes” reported in Bharat Interface for Money (BHIM) or the Unified Payments Interface (UPI) applications.

The National Payments Corporation of India (NPCI) on Monday assured that there is "no vulnerability of loopholes" reported in Bharat Interface for Money (BHIM) or the Unified Payments Interface (UPI) applications.

"We have done intensive testing, robust design of security controls and continuous monitoring of its UPI infrastructure," said NPCI Managing Director and CEO A.P. Hota.

He said the environment in which BHIM or UPI is run by NPCI is highly secure and certified with best global practices and have been audited by reputed IT security firms.

Hota was referring to certain media reports on technical malfunction in some banks' UPI application, and added that NPCI has implemented adequate governance mechanism for banks to report any fraud or system issues and their redressal.

He explained that since BHIM was launched, there have been 19.16 million downloads of which 5.1 million customers have linked it with their bank accounts.

"All downloads do not necessarily lead to activation and usage... In many cases they have downloaded it to see that they have not linked their mobile number to the bank account," he said.

Accordingly, the government has launched a special drive for linking of mobile number with bank accounts for which banks are expected to reach out to their customers and ensure universal acceptance of mobile banking services at the earliest, Hota added.

Catch all the Latest Tech News, Mobile News, Laptop News, Gaming news, Wearables News , How To News, also keep up with us on Whatsapp channel,Twitter, Facebook, Google News, and Instagram. For our latest videos, subscribe to our YouTube channel.