Xiaomi replaces Samsung as the top smartphone seller in India: Canalys and Counterpoint

Samsung claims it has 45% value market share after research firms Canalys and Counterpoint said Xiaomi led the smartphone segment in Q4, 2017.

Xiaomi has replaced Samsung as the top smartphone manufacturer in India, ending years-long streak, as the Chinese handset maker grows more aggressive and expands its presence in the country, market and research firms Canalys and Counterpoint said on Wednesday.

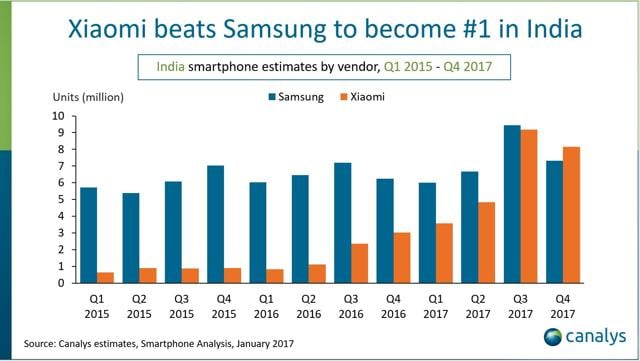

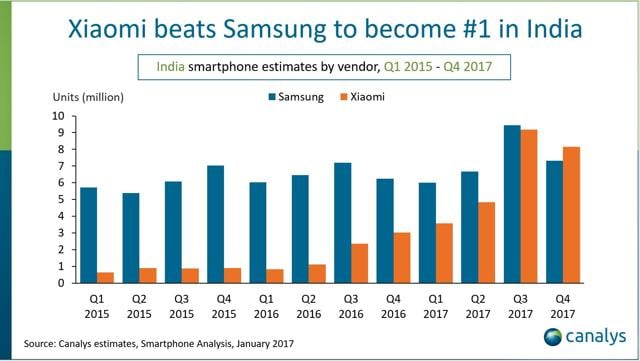

According to Canalys, Xiaomi shipped 8.2 million smartphones in India during the period between October and December last year (Q4 2017). In comparison, Samsung, Canalys said, shipped slightly over 7.3 million units. Xiaomi, with 25% market share, was the top smartphone seller in the nation, ahead of Samsung (23% market share), Counterpoint corroborated, citing data for Q4 2017.

Samsung, which has assumed the tentpole position among smartphone makers for years in the country, refuted the findings by Canalys and Counterpoint Wednesday evening. The South Korean smartphone manufacturer said it remains India's No. 1 smartphone company "by a distance," citing figures from market and research firm GfK. Overall, India's smartphone market grew by 6% with shipment reaching the 300 million milestone for the first time, Counterpoint said.

"As per GfK, which tracks sales to end consumers, in the last (November) quarter Samsung had a 45% value market share and 40% volume market share. Samsung is a full range player and leads the smartphone business across every segment of the India market in 2017," the company said in a statement.

It needs to be pointed out, Canalys and Counterpoint, and Samsung are referring to slightly different metrics. The research firms are evaluating various companies' market share in India on the basis of the number of handsets they have shipped into the market -- as in the inventory sitting in the shelves. Samsung contends that it is still the top handset seller in India if the total revenue generated from smartphones, or the amount of handsets shipped was to be taken into consideration.

"More importantly, Samsung is India's 'Most Trusted' brand. We owe our undisputed leadership to the love and trust of millions of our consumers in India," Samsung added. Overall, Samsung shipped more smartphones than Xiaomi did in India during the entire year of 2017, Counterpoint said.

Regardless of Samsung's views, there is no denying that Xiaomi had a great 2017 in India. Just a year ago, the company had 9% market share in the country, Counterpoint said. The Chinese smartphone maker, which entered India in 2014, focused heavily on online retail channels during its initial years in the country to cut overhead costs. But in the recent years, it has been increasingly expanding its presence in the offline smartphone market as well -- the brick and mortar storer account for more than 70% of all smartphones sold in the country, Counterpoint said.

As of August in 2017, Xiaomi India's president Manu Kumar Jain said the company's smartphones were available from 600 physical retail stores such as chain partners including Vijay Sales and local smartphone shops, in 11 tier 1 and tier 2 cities in India. The company had set a goal of reaching 1,500 retail stores in 30 cities by the end of the year. It is unclear if Xiaomi ended up achieving those goals.

The company has also benefited from the success of the sleeper hit Redmi Note 4 and Redmi 4 mid-range smartphones in India, Counterpoint said. For Samsung, the most popular handsets during the period between October and December last year were Samsung J2 2017 and J7 NXT, the marketing firm said.

Even as Xiaomi may have outperformed Samsung in the Q4 2017, the South Korean smartphone maker had a great 2017 in India, too. Its year-on-year shipment grew by 17% in Q4 2017, Canalys said. The company has also reiterated its commitment to entry and mid-range smartphone tiers by trickling down premium features such as Samsung Pay to many of them.

Xiaomi's success comes at a time when other Chinese smartphone makers have begun to lose their grip in the market. Oppo and Vivo each had 6% market share in Q4 2017, down from 8% and 10% during the same period a year ago, Counterpoint said. Oppo and Vivo have long relied on incentivising retailers for a special treatment to their smartphones. But in the recent years, the incentives have plummeted, industry sources said. Indian smartphone makers such as Micromax, Intex, and Karbonn Mobiles, which once had more than 50% of the market share, continue to struggle in fighting Chinese handset makers.

In the featurephone market, a similar aggression was on display from Reliance Jio. The company, which began shipping the 4G LTE-enabled JioPhone handset last year, was the top featurephone company in the period between October and December, Counterpoint said. Jio had 26% of the market share in that period, while Samsung and Micromax settled with 15 percent and nine percent, according to Counterpoint.

Catch all the Latest Tech News, Mobile News, Laptop News, Gaming news, Wearables News , How To News, also keep up with us on Whatsapp channel,Twitter, Facebook, Google News, and Instagram. For our latest videos, subscribe to our YouTube channel.